New South Wales residents are being urged to check whether they are owed money as almost $300 million remains unclaimed in the state government’s revenue system. The funds are being held by Revenue NSW after businesses and agencies were unable to return payments to their rightful owners.

The pool includes uncashed cheques, refunds, overpayments, dividends and other financial entitlements that were never delivered due to outdated contact details, missing paperwork or changes in personal circumstances.

What Is Unclaimed Money?

Unclaimed money refers to funds that belong to individuals or businesses but could not be paid because the owner could not be located. This can occur when someone moves house, changes their name, closes a bank account or simply forgets about a payment.

In some cases, the money belongs to people who have passed away, where relatives or estate administrators were not aware the funds existed. When businesses cannot locate the rightful owner, the money is transferred to Revenue NSW for safekeeping until it is claimed.

Where Most of the Money Is Located

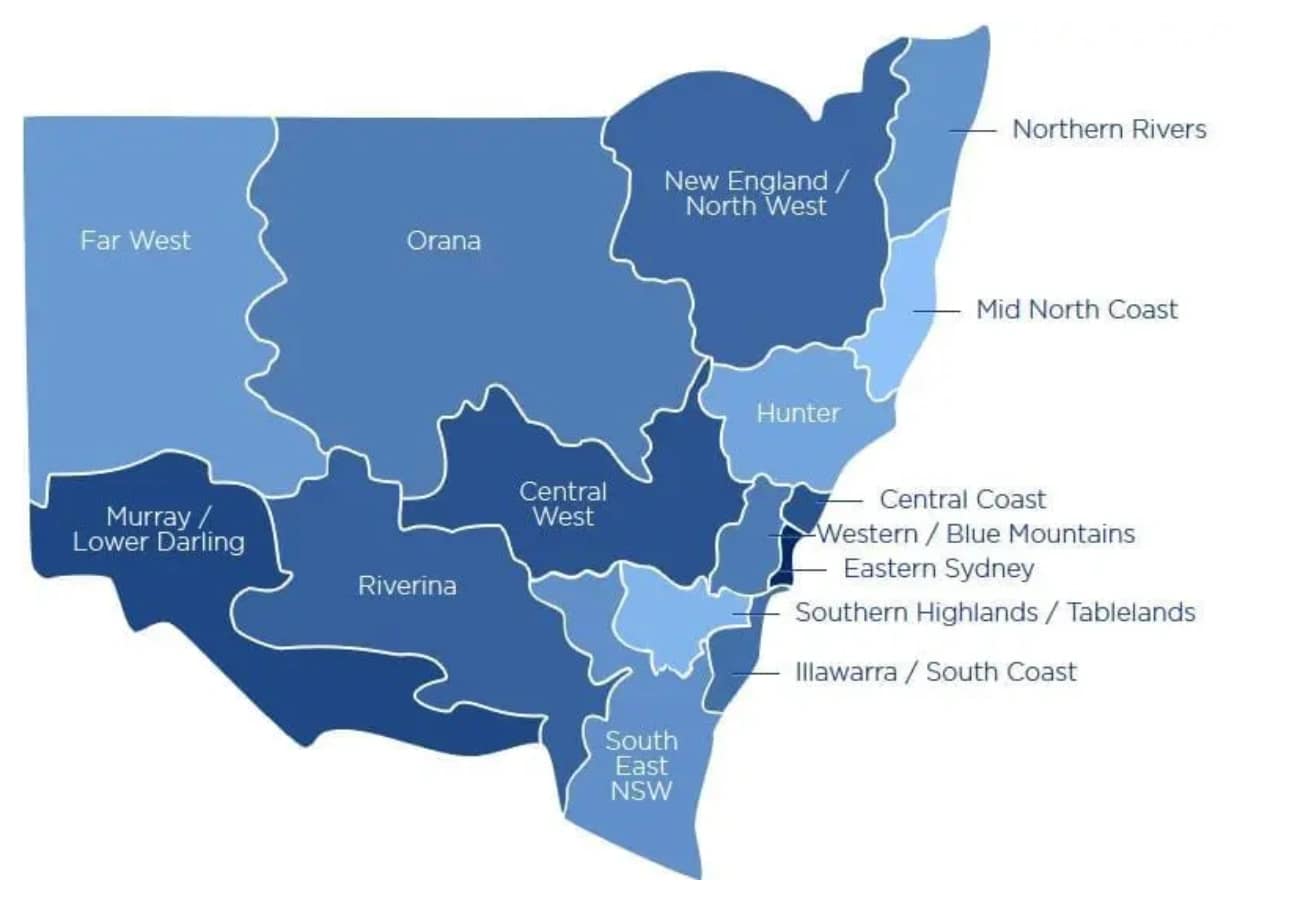

Data released by Revenue NSW shows that Sydney’s city and eastern suburbs hold the largest share of unclaimed money, with more than $91 million waiting to be returned.

Western Sydney follows closely, with around $77 million unclaimed. In regional areas, residents of the Central Coast and Hunter regions are owed approximately $22 million.

These figures highlight how widespread the issue is, with unclaimed money spread across both metropolitan and regional communities.

Interstate Residents May Also Be Eligible

The unclaimed money pool is not limited to current NSW residents. People who previously lived, worked or conducted business in the state may also be entitled to a payment.

Revenue NSW is currently holding almost $395 million in additional unclaimed funds linked to individuals and businesses registered at interstate addresses. This means Australians across the country could be eligible to receive money if they once had financial dealings in New South Wales.

Government Push to Return Funds

NSW Government Procurement Minister Courtney Houssos said the government is focused on returning as much money as possible to families and individuals who are owed it.

She confirmed that more than $21 million was returned to rightful owners during the last financial year alone. The government has also announced legislative changes aimed at making the system faster and more efficient.

Under the new reforms, businesses will only be allowed to hold onto unclaimed money for two years instead of six before it must be transferred to Revenue NSW. This change is designed to ensure funds enter the central system sooner, making them easier to track and recover.

How to Check and Make a Claim

Anyone who believes they may be owed money can search their name using the Revenue NSW unclaimed money portal. If a match is found, a claim can be lodged online.

To verify a claim, applicants must provide two proof-of-identity documents, such as an Australian driver’s licence, Medicare card, proof-of-age card or birth certificate.

In addition, one official document showing a connection to the money is required. This may include a bank statement, phone or electricity bill, or a residential lease linked to the period when the money was owed.

Revenue NSW says most claims are processed within 28 days, although more complex cases, including those involving estates or businesses, may take longer.

Also Read: Liberal Deputy Leader Sam Groth Quits Politics After One Turbulent Term

Final Thoughts

With almost $300 million waiting to be claimed in New South Wales, and hundreds of millions more linked to interstate addresses, thousands of Australians could be owed money they never realised existed.

As cost-of-living pressures continue to affect households, even small payments could provide meaningful relief. Government officials are encouraging residents and former NSW workers to check the database, stressing that the process is free, quick and could uncover funds that have been sitting untouched for years.

FAQs

- What is unclaimed money in NSW?

Unclaimed money includes funds you are legally entitled to but never received. This can include uncashed cheques, refunds, dividends, trust payments and other amounts where the owner could not be located.

- Why does Revenue NSW hold unclaimed money?

Revenue NSW holds unclaimed money on behalf of organisations that could not find the rightful owner due to address changes, lost paperwork, name changes, or the original recipient being deceased.

- How much unclaimed money is there?

Revenue NSW currently holds hundreds of millions of dollars in unclaimed money, including large amounts for both current and former NSW residents. Many Australians may be entitled to funds they have not yet claimed.

- Who can claim unclaimed money?

Anyone who has or had financial dealings in NSW may be eligible to claim unclaimed money. This includes residents, former residents, business owners, and families of deceased individuals.

- How do I check if I am owed unclaimed money?

You can search the unclaimed money register online using your name. If a match appears, you can lodge a claim through the Revenue NSW portal.

- What documents do I need to make a claim?

To claim unclaimed money, you must provide proof of identity and evidence linking you to the funds, such as identity documents and official records that match the information on file.

- Is there a deadline to claim unclaimed money?

There is no deadline on making a claim for unclaimed money in NSW, you can check and claim at any time.

- Can I claim money on behalf of someone else?

Yes. You can lodge a claim for someone else if you have appropriate documentation, such as power of attorney, authority forms, or proof of relationship.