Mining Capital Markets Under Global Scrutiny

London Stock Exchange (LSE) and the TSX Venture Exchange (TSXV) have emerged as the principal mining exploration and fundraising centres. The two exchanges are uniquely positioned in terms of the number of years they have been assisting global resources companies but also in terms of their style/approach considering the geographical location, nature of investors, and regulatory environment.

Historical Role of the London Stock Exchange

LSE has been a desirable source point of global finance for the past 200 years. London has historically been the place where mining companies have sought funds to finance exploration activities around the world. The exchange has listed giants in the African continent, Latin America and Australia. London continues to hold its image as an international capital gateway and has strong connections with institutional investors in Europe and elsewhere.

TSXV’s Position in Mining Finance

The TSXV is a unique exchange that seeks to provide mining financing globally. It focuses on small to mid sized mining companies that are after the initial stage of financing. Canada has gained considerable investor experience in mining through the large amount of mineral deposits in the country. The TSXV assists incipient miners to access capital financing and then advance to the Toronto Stock Exchange (TSX).

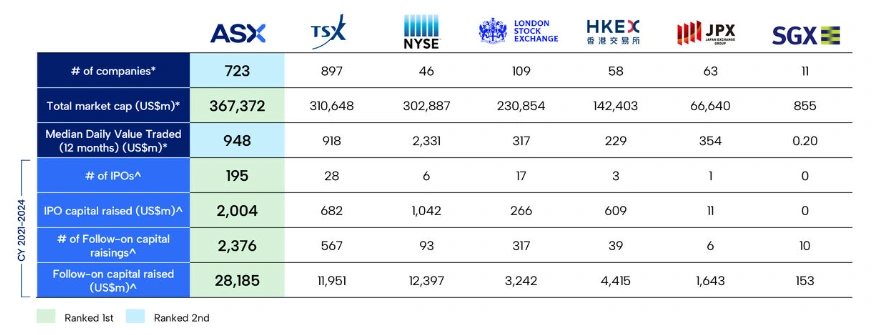

Global Mining Listings and Market Share

The TSXV and the TSX collectively have contributed over 40 per cent of global mining equity capital raising. The exchanges have more than 1,200 companies in the mining category that operate in more than 100 nations. The LSE, participating in a lesser volume of mining, equally has sway through the institutional investments and international investment funds. London-listed companies are large diversified companies with advanced projects.

World leaders in metals and minings

Regulatory Environment in London

The LSE enforces strict listing requirements to attract institutional investors and long-term funds. Firms that are listed in London are expected to disclose exhaustive technical information and they have to meet stiff governance standards. The strengthening of investor confidence is possible with these requirements, particularly on large capital raisings. The financial ecosystem of London results in the adherence to such global reporting standards as Prospectus Regulation and the UK Corporate Governance Code.

TSXV Listing Rules and Flexibility

The TSXV offers more flexible listing requirements for exploration-stage companies. Many juniors rely on the exchange’s streamlined processes to access early capital. Reporting standards remain robust, with Canada’s National Instrument 43-101 ensuring technical accuracy in mineral disclosure. This rule requires companies to publish verified geological information by qualified persons. Investors often view the TSXV as a speculative market but one that drives significant exploration activity worldwide.

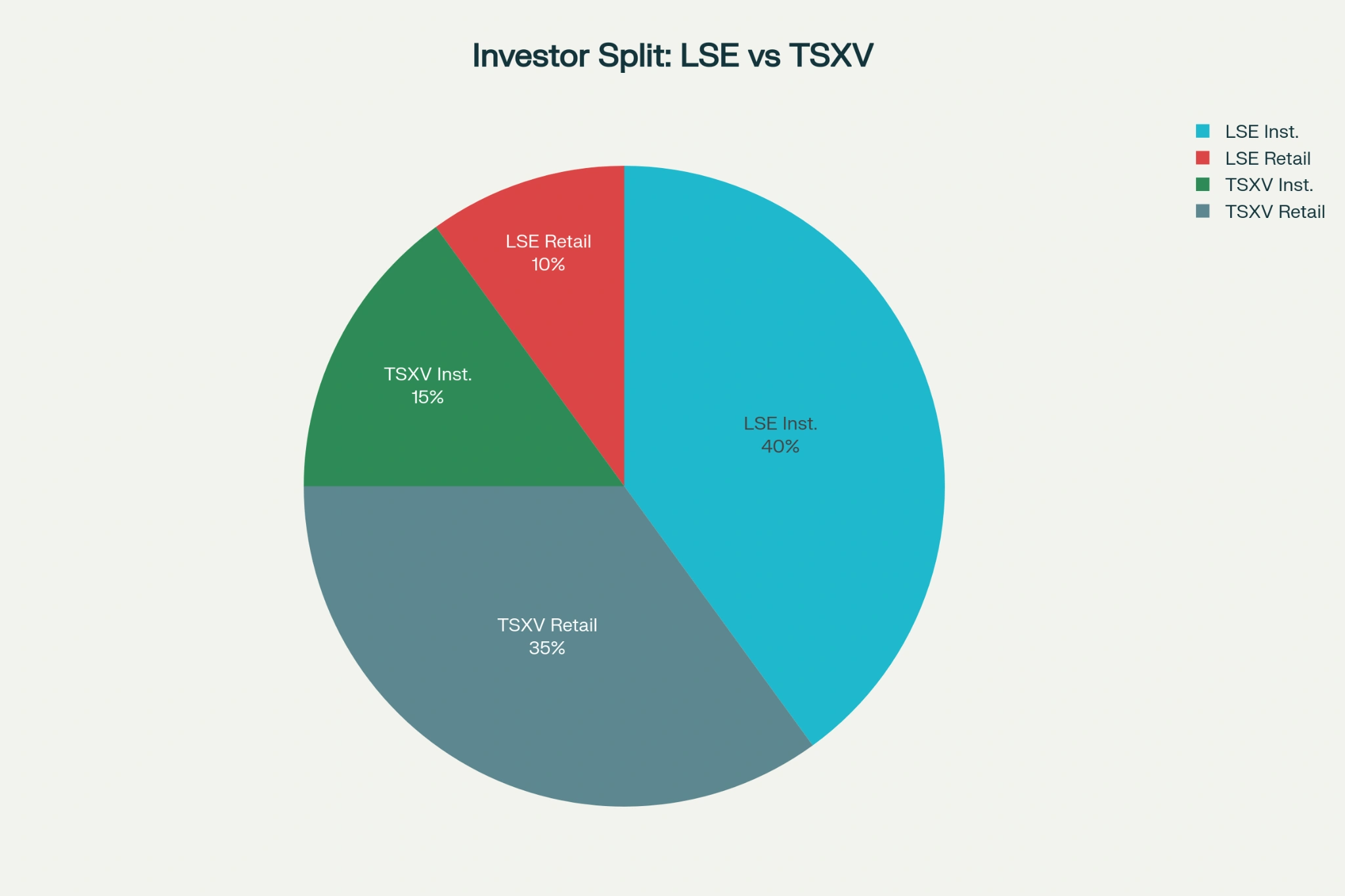

Access to Capital Pools

London provides access to Europe’s deep institutional pools, including sovereign wealth funds, pension funds, and hedge funds. These investors often prefer larger, later-stage mining companies with stable returns. By contrast, the TSXV caters to retail investors and specialised funds willing to accept higher risk for higher potential returns. This difference in investor base shapes the type of mining companies that choose each market.

Secondary Listings and Dual Market Strategy

Many companies adopt dual listings to benefit from both exchanges. Australian, African, and Latin American miners often list in London for institutional capital while retaining a TSXV presence for retail liquidity. Dual listings improve visibility, diversify investor bases, and provide flexible access to fundraising across continents.

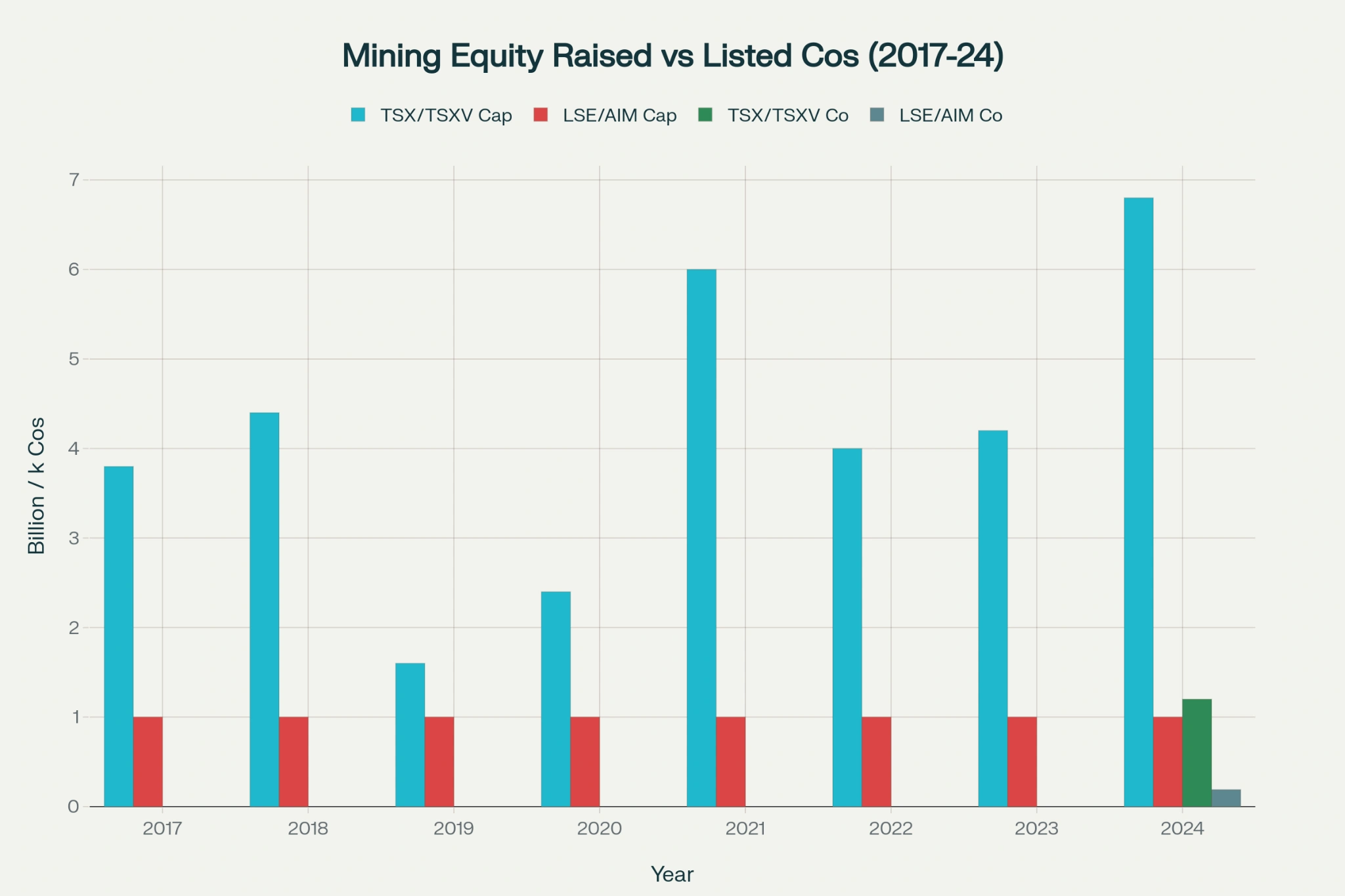

Scale of Fundraising

The TSX and TSXV together raised more than CAD 7 billion for mining in 2023. Over 40 per cent of global mining financings flowed through Canada. The LSE raised smaller amounts but retained influence in large-scale equity offerings, particularly for diversified miners. Both exchanges remain essential in sustaining global exploration pipelines.

Mining equity financing over the past 5 years ($ Billions)

Geographic Reach and Influence

The LSE serves as a financial hub for projects across Africa, the Middle East, and Eastern Europe. Its historical ties with former Commonwealth countries strengthen capital flows. The TSXV dominates funding for projects in Canada, Latin America, and increasingly Africa. Canadian-listed juniors often enter Africa early, backed by risk-tolerant investors seeking discoveries.

| Factor | LSE | TSXV |

| Age & Role | Over 200 yrs, global finance gateway | Dominant for junior mining companies |

| Main Strength | Inst. capital, large diversified firms | Early-stage, flexible funding, exploration |

| Listing Rules | Strict, major compliance, ESG priority | Flexible, NI 43-101 standard |

| Investors | Institutional, long-term | Retail, speculative, specialist funds |

| Liquidity | High for large caps, lower for juniors | Strong for juniors, high retail volume |

| Capital Raised | Lower volume, larger scale | Highest global equity capital, many deals |

| Geographic Influence | Africa, Middle East, Europe | Canada, LatAm, Africa, global reach |

| Governance/ESG | Strong frameworks, ESG leadership | Growing ESG focus, practical governance |

Table 1: Comparative Overview of LSE & TSXV

Role of Institutional Investors

Institutional investors dominate the London market. Large asset managers favour companies with advanced feasibility studies and near-term production. The LSE environment promotes long-term growth strategies with stable shareholder bases. In Canada, institutional presence is smaller, with retail investors and mining-focused funds shaping capital allocation. This structure enables Canadian juniors to finance exploration drilling, geophysical surveys, and resource definition.

Technical Reporting Standards

Canada’s NI 43-101 is a global benchmark in mining reporting. These standards were developed through past scandals and are also important in making accounts transparent. LSE makes use of the Joint Ore Reserves Committee (JORC) Code, used by Australian companies and other global reporting frameworks. Both exchanges have been prioritising investor protection, though Canada has a more specific structure with more technical details.

Market Liquidity Considerations

The TSXV provides strong liquidity for smaller mining stocks due to its retail investor base. Junior explorers often rely on high trading volumes to raise incremental capital. The LSE offers deeper liquidity for larger companies but less flexibility for small-cap issuers. Many juniors find survival difficult on the LSE without strong institutional backing.

Valuation Dynamics Across Exchanges

This can often be a big variation between valuation on the LSE and TSXV on an investor preference basis. Canadian investors commonly assign early exploration potential a value. The investors in London are more interested in the financial stability, cash flow and development milestones. These differences in valuation may play a role in such strategic decisions executed by mining executives concerning listing.

Corporate Governance Standards

The LSE enforces comprehensive governance frameworks, including board independence, audit structures, and sustainability reporting. The exchange expects miners to align with environmental, social, and governance (ESG) benchmarks. The TSXV applies governance requirements but often with more flexibility given its exploration focus. However, Canadian regulators increasingly emphasise ESG reporting as investors demand accountability.

ESG and Sustainability Focus

London’s financial community prioritises ESG integration across all sectors, including mining. Investors expect companies to disclose emissions targets, community engagement, and biodiversity strategies. The TSXV, while historically focused on exploration, now sees ESG as a growing requirement. Junior miners disclose community agreements and environmental practices to meet investor expectations and secure financing.

Cost of Capital

The cost of capital often differs between the two exchanges. The TSXV allows juniors to raise funds through smaller placements, often with warrants attached. These structures lower upfront costs for issuers but dilute shareholders. The LSE provides larger pools of capital at lower dilution, but companies face higher compliance expenses. Executives weigh these trade-offs when selecting their listing venue.

Mining capital raised and listings: TSX/TSXV vs LSE/AIM (2017–2024).

Role of Investment Banks and Brokers

The role of the London investment banks cannot be underestimated in structuring the deals of mining companies. These institutions facilitate linkage of issuers to world investors in the form of placement, rights issue and initial public offers. The network of broker-dealers in Canada is more retail oriented, and firms specialise in mining financings. Both markets present the much-needed financial infrastructure in line with the requirements of investors.

Secondary Trading and Retail Participation

The retail investor-based market creates high price volatility in junior stocks in the TSXV market. The speed of dealing indicates the change in prices of commodities and exploration outcomes. The London market provides a better base but not the amount of speculative force. This dynamism draws various profiles of companies to the different exchanges, which influences the development strategies of the said exchanges.

Investor base composition comparison: LSE vs TSXV for mining companies

International Competition for Mining Listings

Exchanges in Australia, Hong Kong, and Johannesburg compete with the LSE and TSXV for mining listings. The Australian Securities Exchange (ASX) attracts many domestic miners, especially in gold and lithium. Johannesburg remains important for African projects. Despite competition, London and Toronto maintain their status as global mining finance leaders.

Importance of Dual Strategies for Juniors

Exploration companies often consider staged strategies when entering public markets. Many start on the TSXV to secure early risk capital. As projects mature, companies seek London listings to access institutional funds. This dual pathway allows flexibility and supports project development from early drilling to construction finance.

Case Studies of Listings

A number of African-centric gold mining companies have opted to list in London as a primary listing and keep a secondary listing in Canada. Australian companies dealing with lithium tend to seek dual listing to attract the global market. Canadian explorers in Latin America commonly use the TSXV in cost-efficient financing. These patterns speak of the advantages and shortcomings of the two exchanges.

Centamin PLC is listed primarily on the LSE and secondarily on the TSX

Commodity Cycles and Exchange Dynamics

Commodity price cycles strongly influence fundraising volumes. During gold bull markets, the TSXV sees increased financing for junior explorers. The LSE captures larger offerings from established producers during stable or growth cycles. Both exchanges adapt to changing commodity trends, with investor appetite shifting between exploration and production risk.

Role in Global Exploration Spending

The TSXV directly fuels exploration spending worldwide. Thousands of junior companies rely on small equity raises to fund drilling programs. The LSE contributes by financing development and construction stages, ensuring projects transition to production. Both exchanges together sustain the global exploration pipeline essential for future supply.

Outlook for London

By improving ESG standards and luring new global funds, London can boost its mining profile. The LSE tries to stay relevant in contrast to Toronto and Sydney by being digitalised, by simplifying processes and reaching the world. The large-scale developments still rely on their institutional base.

Outlook for Toronto

The TSXV remains the dominant funding source for early-stage mining projects. This infrastructure of geologists, financiers, and brokers guarantees a flow of capital to the juniors. Toronto has a solid lead in the discovery phase of investment that is backed by government incentives and local research capabilities. Canadian capital markets are likely to be dominant in world mining equity.

Comparative Strengths and Weaknesses

The LSE is able to provide depth, stability and institutional spread among advanced miners. The TSXV brings flexibility, liquidity and risk capital to explorers. The two exchanges serve as complementary so that the miners can map out growth directions across jurisdictions. The two, in their capacity, are essential in the development of resources in the face of increasing global demand.

Final Outlook

The LSE and TSXV will continue shaping global mining exploration and capital raising. Their contrasting models reflect different stages of project development and investor appetite. Companies will increasingly combine both exchanges to optimise funding strategies. The global mining sector relies on these hubs to secure exploration spending and maintain supply for future demand.