Chipmaker Hits Record Market Value

Nvidia has become the first publicly listed company to reach a $US4 trillion ($6.12 trillion) market valuation during intraday trading. The Silicon Valley-based chipmaker briefly crossed the milestone on Wednesday before retreating to close with a valuation slightly below the threshold. Nvidia shares closed at $US162.88, down from their peak earlier in the session.

Nvidia became the world’s most valuable company with a valuation of $US4 trillion

AI Demand Fuels Historic Stock Surge

Investors continue to fuel Nvidia’s rapid stock rise amid surging demand for its artificial intelligence processors. Nvidia’s chips now power AI operations across many global tech platforms. Since early 2023, Nvidia’s market value has climbed from $US400 billion to $US4 trillion, marking a tenfold increase in just 18 months. Analysts attribute this growth to the AI wave that has gripped major sectors globally.

AI Rivals Trail Nvidia’s Dominance

Nvidia now holds a market value nearly $US900 billion higher than Apple. Apple became the first company to reach a trillion-dollar valuation, followed by a 2 trillion-dollar valuation, and later a 3 trillion-dollar valuation. Apple has struggled to incorporate AI into its flagship iPhone and other product lines. Meanwhile, Nvidia’s AI-focused strategy has enabled it to outpace its rivals and solidify its position as a leader in the next tech cycle.

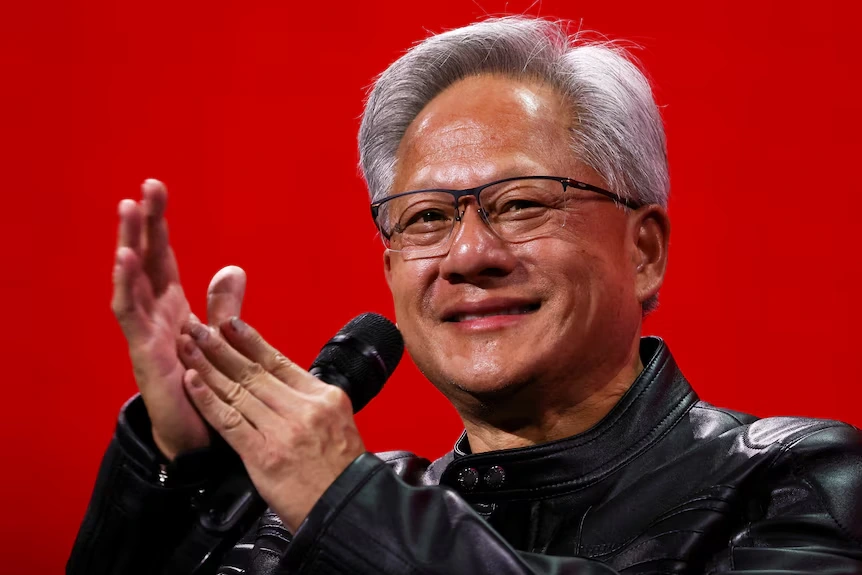

Jensen Huang Dubbed AI Godfather

The company’s founder and chief executive, Jensen Huang, has become a prominent figure in the global AI movement. Huang’s public presentations attract wide attention as he explains the future of AI. His fortune now stands at an estimated $US142 billion. Analysts and investors credit Huang’s leadership with navigating Nvidia through volatile markets and driving forward AI adoption.

Jensen Huang has become the face of the AI revolution

Tech Giants Boost AI Investments

Microsoft, Amazon, Alphabet and Meta have collectively committed around $US325 billion this year to AI investments. These companies rely heavily on Nvidia’s processors to support their AI projects. A significant portion of these funds is expected to benefit Nvidia directly. The company’s chips are essential for training large AI models and handling intense data workloads.

Analysts Predict Continued Growth

Despite the stock closing below $US4 trillion on Wednesday, many analysts believe Nvidia will climb further. CFRA analyst Angelo Zino projected Nvidia’s stock would hit $US196 within the following year. This would raise Nvidia’s valuation to about $US4.8 trillion. Market confidence remains strong, with investors betting on sustained demand for Nvidia’s technology.

Nvidia Rebounds From Early 2024 Dip

Nvidia faced a temporary setback in April when US President Donald Trump announced sweeping tariffs. The announcement triggered a broad sell-off across the tech sector. Nvidia’s stock dropped below $US87 at its lowest point during that period. However, the company recovered quickly and reported a strong quarterly performance in late May.

Company Posts Massive Quarterly Profit

In its most recent earnings report, Nvidia posted a $US18.8 billion profit for the quarter ending in May. The company absorbed a $US4.5 billion loss due to US government restrictions on chip exports to China. Even with the export limitations, Nvidia exceeded expectations and continued to gain market share in the AI chip space.

Also Read: Musk’s Grok AI Sparks Global Outrage with Antisemitic Posts as X CEO Yaccarino Resigns Amid Turmoil

Next Earnings Report Expected In August

Nvidia is scheduled to release its next quarterly report on August 27. Analysts and investors are watching closely to see if the company maintains its momentum. With tech companies scaling up AI deployment, Nvidia’s chips remain a vital component in data centres and cloud infrastructure.

New Competition Emerges In AI Hardware

While Nvidia continues to dominate, other players are entering the AI hardware space. Former Apple designer Jony Ive has joined OpenAI to develop a wearable AI device. Some analysts see this project as a potential contender for the iPhone. However, Nvidia is focused on powering AI ecosystems rather than building consumer devices.

Investors Signal Long-Term Confidence

Despite short-term volatility, the market has shown sustained confidence in Nvidia’s AI strategy. The company’s dominance in AI chips positions it at the centre of ongoing digital transformation. Analysts expect demand for Nvidia’s GPUs to continue rising as businesses and governments globally adopt AI solutions.

AI Ushers In New Tech Era

While AI is reshaping industries, Nvidia stands at the leading edge, redefining the direction of global innovation. Many observers see this moment as the most significant disruption since Steve Jobs introduced the first iPhone 18 years ago.