The Reserve Bank of Australia confronts a critical turning point as 2026 begins. The central bank maintained the cash rate at 3.6% throughout late 2025. However, Governor Michele Bullock signalled a dramatic policy shift away from rate reductions toward potential increases. The RBA board expressed heightened concern regarding inflation risks that tilted upward following recent economic data.

Australia’s inflation remains stubbornly elevated above the RBA’s preferred 2-3% target range. Headline inflation reached 3.8% in October, whilst core inflation climbed to 3.3%. The Reserve Bank acknowledged signs of “a more broadly based pick-up in inflation” that warranted close monitoring. This sentiment represents a substantial departure from 2025’s easing stance that delivered three consecutive rate cuts.

Australia’s 2026 Interest Rate Forecast

Economists Now Forecast Multiple Rate Hikes in 2026

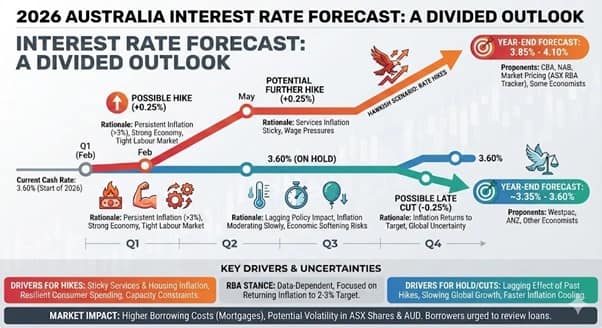

Major Australian banks have revised forecasts dramatically in recent weeks. The Commonwealth Bank expects a 0.25% point increase in February, bringing the cash rate to 3.85%. National Australia Bank predicts two hikes occurring in February and May. Judo Capital Holdings takes a more hawkish stance, forecasting a 0.4% point rise in February, followed by consecutive 0.25 point increases.

A poll conducted by The Australian Financial Review surveyed 38 economists. Seventeen of those economists predicted at least two rate hikes within the next 18 months. Seven economists, including those from Commonwealth Bank and National Australia Bank, expect rate increases beginning as early as February. Conversely, Westpac and some analysts argue inflation pressures contain temporary elements that will ease naturally.

Market pricing reveals strong expectations for rate increases by mid-2026. Current market assessments show a 34% probability of a February hike. By June, market expectations for a rate increase rise dramatically to 93%. Trading Economics econometric models project the Australian interest rate will trend around 4.1% by 2026’s conclusion.

Multiple hikes forecasted in 2026

Economic Strength Drives Inflation Concerns

Australia’s economy exhibited unexpected resilience throughout 2025, creating capacity constraints that fuel inflation. Household spending accelerated beyond expectations whilst businesses invested heavily in data centre infrastructure. The unemployment rate fell to 4.3%, indicating a tight labour market. Wage growth continues rising as workers demand compensation reflecting accumulated inflation pressures.

The RBA board noted that “the economy seems to be experiencing excess demand” and questioned whether current financial conditions remain “sufficiently stringent”. This language indicates the central bank believes interest rates may prove insufficiently restrictive to control inflation. The combination of stronger growth, low unemployment, and persistent inflation creates textbook conditions for rate increases.

Inflation Data Release Will Determine February Decision

The Australian Bureau of Statistics will release December quarter inflation data on January 28. This critical release will guide the RBA’s February 3 interest rate decision. Reserve Bank Governor Bullock emphasised that trimmed mean inflation—the bank’s preferred measure—will play a significant role in these discussions.

The RBA previously warned against over-interpreting any single data point. Nevertheless, market participants consistently react sharply to inflation releases. Economic analysts expect continued inflation above the RBA’s target range, though most projections show gradual moderation into the second half of 2026. However, the pace of that moderation remains uncertain given external factors including U.S. tariff policies.

Mortgage Stress Will Increase if Rates Rise

Australian households face considerable pressure from elevated housing costs already. Research shows that 25.3% of mortgage holders experienced stress in October 2025, even after rate reductions. Canstar analysis indicates that each 0.25% increase adds between $90 and $150 monthly to mortgage repayments for loans between $600,000 and $1 million.

Roy Morgan data reveals that lower-income households suffered deteriorating circumstances despite 2025’s rate cuts. The bottom 40% of earners experienced increased mortgage stress levels, contrasting sharply with the top 60%. A quarter of current mortgage holders face genuine risks regarding repayment capacity.

Housing remains Australia’s top financial concern for the fourth consecutive year. Canstar’s Consumer Pulse Report shows 26% of property owners consider selling within two years. Of those considering sales, 19% cite inability to afford higher loan repayments—up from 16% annually.

Mortgage Stress

ASX Banks Benefit from Rising Rate Environment

Higher interest rates present advantages for Australia’s major banks. Macquarie Research estimates that 50 basis points worth of rate hikes throughout 2026 would materially enhance bank margins. Commonwealth Bank and Westpac are forecast to benefit more substantially than ANZ and NAB.

The ASX 200 sharemarket faces headwinds from rising interest rates. Generally, rate increases reduce equity valuations as investors demand higher returns from alternative investments. The Australian dollar strengthens as rate expectations increase, potentially dampening earnings for exporters.

Bond markets offer compelling opportunities at historically attractive yields. Fixed income investors benefit from higher carry returns as central banks maintain restrictive policy settings throughout 2026.

Also Read: Respected Australian Media Personalities Mourn Tim Stoney Death After Long Journalism Career

Property Market Growth Will Moderate

Real estate specialists warn property investors to approach 2026 cautiously. The market recorded only 0.7% growth in December, marking the smallest monthly rise in recent years. Analysts expect Australian home price gains to slow to 5-7% in 2026, compared to 8.5% in 2025.

Rising interest rates, mortgage stress, and supply-demand imbalances will constrain property appreciation. APRA’s macro-prudential policy tightening adds additional headwinds for property market participants.

Conclusion

The Reserve Bank stands poised to abandon monetary easing as 2026 unfolds. Inflation persistence and economic strength virtually guarantee sustained focus on rate increases. Australian households and investors must prepare for a dramatically altered financial environment.

Disclaimer