Iluka Resources (ASX:ILU) has adopted a dual operational strategy at a critical juncture for its rare earths refinery and mineral sands operations. The company continues advancing its Eneabba rare earths refinery project, while also announcing an operational curtailment through the mothballing of its Cataby mine and related synthetic rutile activity. This combination of forward momentum and prudent project suspension deeply influences both the domestic mining workforce and the global rare earths supply narrative.

Figure 1: Iluka has adopted a dual operational strategy

Iluka’s Strategic Shift

Iluka Resources proceeds with a calculated approach to address subdued demand in the mineral sands market. The management decides to mothball the Cataby mine and related refinery north of Perth, demonstrating decisive action under strained market conditions. The shares react with a marked decline, reflecting market sentiment towards the curtailment.

Curtailment at Cataby

The Cataby mineral sands mine had recently increased its production, reaching 184,000 tonnes of heavy mineral concentrate in the first quarter of 2025. Higher ore volumes and improved grades led to this result, while synthetic rutile output remained steady at 55,000 tonnes. The company cites subdued global demand as the primary driver for mothballing.

Zircon sand sales surged in Q1 2025, with 48,000 tonnes sold, which marked a 116% increase from the previous quarter. However, prices report a modest decline to US$1,698 per tonne. The decline sees revenue from mineral sands slide to $260 million for the first quarter, down 3% on a quarterly basis, prompting Iluka to pause supply from Cataby as a protective cost management measure.

Figure 2: The Cataby mineral sands mine

Figure 2: The Cataby mineral sands mine

Rare Earths Refinery Momentum

While suspending one major operation, Iluka simultaneously intensifies focus on the Eneabba rare earths refinery. The refinery represents Australia’s first fully integrated facility for producing separated rare earth oxides. Located 280 kilometres north of Perth, it will process both Iluka’s and third-party concentrates.

Capital expenditure at Eneabba reaches $408 million, with all major equipment awarded and foundational works well underway. The Eneabba refinery stands as a linchpin in Iluka’s plan to provide Western markets with reliable supplies of rare earths such as neodymium, praseodymium, dysprosium, and terbium.

Figure 3: Eneabba rare earths refinery is located 280km north of Perth, Western Australia

Figure 3: Eneabba rare earths refinery is located 280km north of Perth, Western Australia

Balancing Production and Investment

Iluka’s operational results for the first quarter of 2025 exhibit 131,000 tonnes of zircon, rutile, and synthetic rutile produced. Sales reached 116,000 tonnes, despite pricing headwinds. The management attributes this balance to prioritising zircon in concentrate, meeting evolving market needs and safeguarding margins.

Managing Director Tom O’Leary states, “Our first half production was strong, complemented by zircon-in-concentrate volumes, which we prioritised given market conditions. Combined with cost initiatives implemented in 2024, this enabled the company to preserve margins despite pricing pressure.”

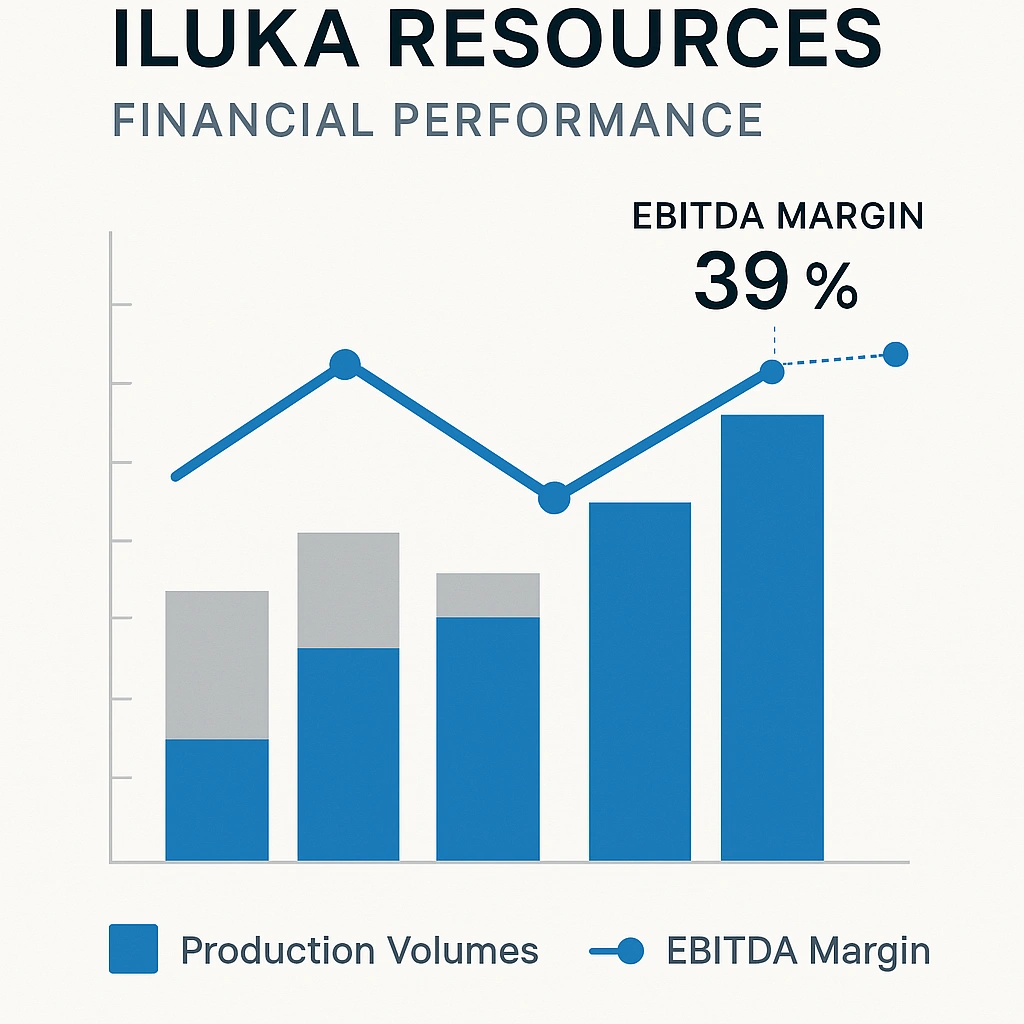

Financial Resilience Amid Uncertainty

Despite headwinds, Iluka records a net profit after tax of $92 million in the first half of 2025. The EBITDA margin holds steady at 39%, revealing strong cost controls and operational discipline. Iluka’s capital investment during this period tallies $402 million, signalling its commitment to development even while tightening operational budgets.

Figure 4: Iluka’s EBITDA margin and production metrics for 2025

Figure 4: Iluka’s EBITDA margin and production metrics for 2025

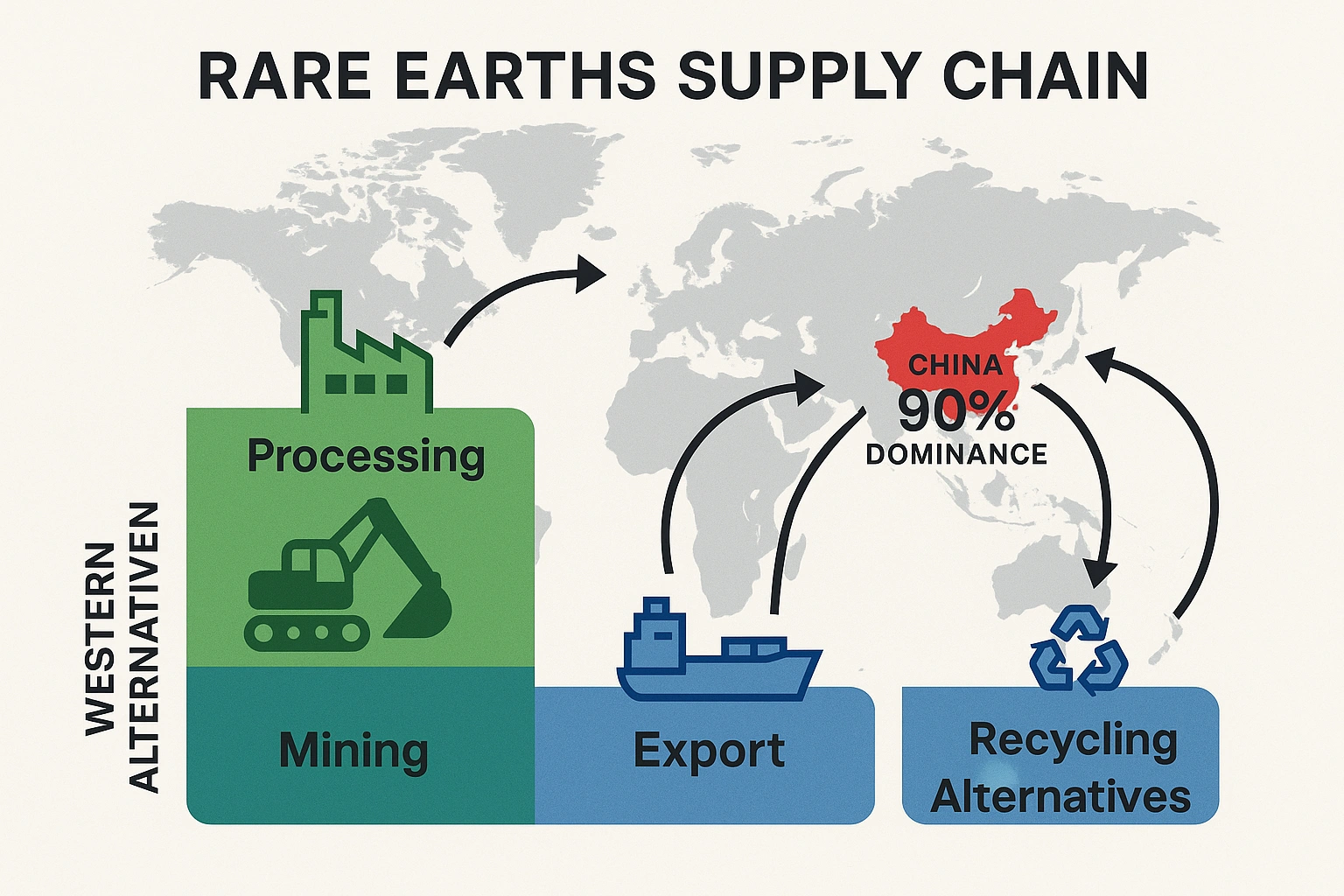

Tariffs, Trade Policy, and Rare Earth Supply

Global tariffs and trade policy dictate much of the company’s strategic moves. Titanium feedstocks, including rutile and synthetic rutile, remain exempt from recent US tariffs, protecting the company’s core business in this segment. Zircon faces a 10% tariff for US exports, but with limited exposure as the US accounts for only 6% of Iluka’s sales in 2024.

Meanwhile, China, which produces about 90% of the world’s rare earths, adds medium and heavy rare earths to its export control list. This geopolitical twist increases the strategic significance of the Eneabba refinery, scheduled for commissioning in 2027.

Once operational, the facility will be the only material Western producer of heavy rare earth oxides, serving critical needs in defence, robotics, electric and hybrid vehicles, and renewable technology.

Figure 5: Global rare earths supply chain highlighting China’s dominance and Western alternatives

Figure 5: Global rare earths supply chain highlighting China’s dominance and Western alternatives

Project Pipeline and Supply Chain Flexibility

Iluka’s rare earth strategy extends beyond Eneabba. The Balranald project, with construction progressing and commissioning set for the second half of 2025, will feed an additional 5,000 tonnes per annum of rare earth concentrate from 2026. The Wimmera project in Victoria, currently undergoing a definitive feasibility study, could contribute 15,000 tonnes per annum with a 25-year mine life.

Strategic partnerships underpin long-term feedstock security. Iluka secures supply agreements with Lindian Resources and Northern Minerals, ensuring a diversified and stable rare earth concentrate input, aligning with global trends towards robust, independent supply chains.

Domestic and Global Impact

The dual strategy creates ripples across the Australian workforce and international markets. While the mothballing of Cataby may affect regional employment, construction of the Balranald and Eneabba projects provides alternative economic stimulus, with up to 250 jobs during construction and ongoing roles in operations.

The change in supply strategy also supports broader critical mineral policies. Australia establishes itself as a safe, long-term rare earths supplier for Western industry requiring non-Chinese sourcing, particularly in light of new security and trade priorities.

Also Read: Benz Mining Expands Glenburgh’s High Grade Gold System with New Drill Results

Environmental and Regulatory Standards

Iluka constructs the Eneabba refinery to the highest environmental, social, and governance standards expected in Australian mining. The state-of-the-art, zero-liquid discharge design allows water and reagent recycling, minimising environmental impact and complying with national regulations.

The Broader Market Narrative

Market prices across Iluka’s product portfolio reflect the volatility facing global resource businesses. Iluka’s average zircon price declines, aligning with downward movements among main competitors yet signals modest resilience.

The company’s ability to maintain nearly $115 million in operating cash flow for the first half of 2025, despite a lower revenue base, underlines its adaptability. Strategic investment in project development continues even amid belt-tightening, reinforcing a vision geared towards long-term stability over short-term profit.

Conclusion

Iluka Resources now operates at a critical point marked by both retrenchment and investment. The dual strategy encapsulates a clear commitment to securing Australia’s rare earth future, even at the cost of curtailing current mineral sands output.

With the Eneabba refinery progressing, partnerships strengthening supply chains, and new projects poised to contribute, Iluka positions itself as a pillar in the evolving rare earths supply landscape. The company walks a tightrope—controlling costs and protecting margins today, while investing for Western resource security in the decade ahead.