BlueScope Steel Limited (ASX: BSL) has confirmed it has received an unsolicited, non-binding and indicative $30.00-per-share cash takeover proposal from an Australian–US consortium led by SGH Limited (ASX: SGH) and Steel Dynamics, Inc. (NASDAQ: STLD). The disclosure followed a period of market speculation and was formally released to the ASX on 5 January 2026.

BlueScope Steel’s operations span Australia and North America, underpinning its strategic value to potential acquirers (Source: BlueScope)

The proposal, received on 12 December 2025, would see SGH acquire all BlueScope shares via a scheme of arrangement before selling the Company’s North American steel operations to Steel Dynamics. The structure highlights the strategic value of BlueScope’s US business, which operates in one of the world’s most profitable steel markets. The announcement placed a formal valuation marker on BlueScope at a time when the Company is entering a phase of rising cash flow, asset monetisation and earnings growth.

The proposal remains highly conditional and does not yet constitute a binding offer. It includes conditional debt funding and is subject to multiple approvals designed to protect both parties. Key elements and conditions include:

- Offer price: $30.00 cash per share

- Transaction structure: SGH acquires BlueScope, then sells North American operations to Steel Dynamics

- Status: Unsolicited, non-binding and indicative

- Funding: Highly conditional debt support

- Key conditions: Due diligence, exclusivity, no material adverse change, unanimous board recommendation, shareholder approval, no further share buy-backs, and regulatory and consortium board approvals

Board Assessment of BlueScope’s Intrinsic Value

BlueScope’s board said it will evaluate the offer relative to the Company’s fundamental value, which is underpinned by earnings strength, growth investment, and asset backing. Four key valuation drivers were identified:

- High-quality steel and coated-products businesses are positioned to benefit from productivity improvements and a return to mid-cycle spreads

- A material increase in cash flow as capital expenditure falls, working capital is released, and proceeds from India and West Dapto transactions are received

- A $2.3 billion growth program targeting $500 million per year in additional earnings by 2030

- Latent value of 1,200 hectares of landholdings being rezoned, developed, and monetised

Why the North American Business Is Strategically Critical

Steel Dynamics’ interest reflects the premium value of BlueScope’s North American steel assets, which benefit from strong infrastructure spending, manufacturing reshoring, and energy transition investment. These operations are among the most efficient in the region and deliver higher margins than many global peers, making them strategically attractive in an increasingly consolidated global steel industry.

Steel Dynamics’ interest highlights the strategic importance of BlueScope’s North American steel operations. Source: (Recycling Today)

BlueScope has previously cautioned that separating these operations could increase execution and regulatory risk, potentially reducing the value of the Company’s integrated global platform.

History of Rejected Approaches and Valuation Tension

The board confirmed it has previously rejected three approaches. In late 2024, Steel Dynamics-led offers of $27.50 and $29.00 per share were declined. In early 2025, a more complex proposal valued the North American business at $24.00 per share and the remaining assets at at least $9.00 per share. These proposals were rejected because they undervalued BlueScope and carried material regulatory and execution risk.

Global Steel Market and Strategic Positioning

Global steel demand continues to be supported by infrastructure pipelines, defence spending, and energy transition initiatives, particularly in the United States and Australia. BlueScope’s focus on coated and value-added steel provides exposure to higher-margin segments of the market.

The Company has appointed UBS as financial adviser and Herbert Smith Freehills Kramer as legal adviser while assessing the proposal and evaluating strategic alternatives.

ASX Market Reaction and Trading Activity

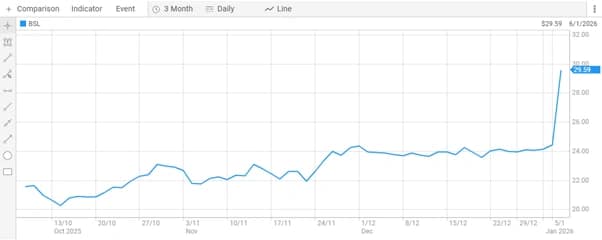

BlueScope shares surged following confirmation of the takeover proposal, closing at $29.590, up $5.140 or 21.02 per cent, on heavy volume of 3,534,850 shares. The stock traded within a narrow bid–offer range of $29.590 to $29.600, indicating strong institutional demand and limited selling pressure.

BlueScope shares surged 21% to $29.59 following confirmation of the $30-per-share takeover proposal (Source: ASX)

The rally lifted BlueScope’s market capitalisation to approximately $10.71 billion, placing the stock among the ASX’s strongest-performing large-cap industrials for the session. Trading just below the $30.00 indicative bid, the market signals a high probability of further corporate action, while factoring in execution and regulatory risk.

Also Read: Carbonxt Group Secures $600k Placement to Advance New Carbon Investment

What Happens Next for BlueScope Shareholders

Shareholders are not required to take any immediate action. While there is no certainty that the current proposal will result in a binding offer, the $30-per-share bid has set a valuation floor and reinforced BlueScope’s strategic value as it enters a period of rising cash flow, asset monetisation, and earnings growth.