CSL Ltd shares plunged sharply on Tuesday following a series of announcements that shook investor confidence. The Australian biotech giant reported delays in spinning off its vaccine division and cut its profit outlook for the fiscal year 2026. The company attributed these setbacks to a dramatic decline in influenza vaccination rates in the United States. This news sent CSL shares down by as much as 16.6%, hitting a near seven-year low and marking the largest intraday drop since 2018.

Major decline in CSL Ltd shares

Downward Revision of Financial Guidance

CSL now forecasts full-year revenue growth of just 2% to 3%, down from an earlier projection of 4% to 5%, for the financial year ending June 2026. The company also reduced its net profit after tax before amortisation (NPATA) growth forecast to 4% to 7%, a notable cut from its previous outlook of 7% to 10% growth. CEO Paul McKenzie stated, “In our Seqirus business, we have seen a greater decline in influenza vaccination rates in the U.S. than we expected.”

Seqirus Spin-off Postponed

The planned spin-off of CSL’s vaccine division, Seqirus, scheduled for fiscal 2026, has been postponed indefinitely. The company cited “heightened volatility” in the critical U.S. market as the primary reason for the delay. CSL had communicated to shareholders in August that it intended to separate Seqirus and list it independently on the Australian Securities Exchange by June next year as part of a broader restructuring initiative. This restructuring also includes cutting approximately 3,000 jobs globally, representing about 15% of CSL’s workforce outside the U.S. plasma operations.

CSL’s vaccine division, Seqirus has been postponed indefinitely

US Vaccination Rates Impact

The company warned that influenza vaccination rates in the United States are projected to decline by 12% overall and by 14% among those aged over 65 during the northern hemisphere’s upcoming winter. This drop reflects a wider shift in public attitudes towards vaccines. CSL chairman Brian McNamee described the collapse in vaccination rates as “remarkable” and added, “We can’t see the bottom of the U.S. vaccination realities today.” The decline has been linked to policy changes under U.S. Health Secretary Robert F. Kennedy Jr., who has criticised vaccines, cut funding for vaccine research, and removed key personnel at the Centers for Disease Control and Prevention.

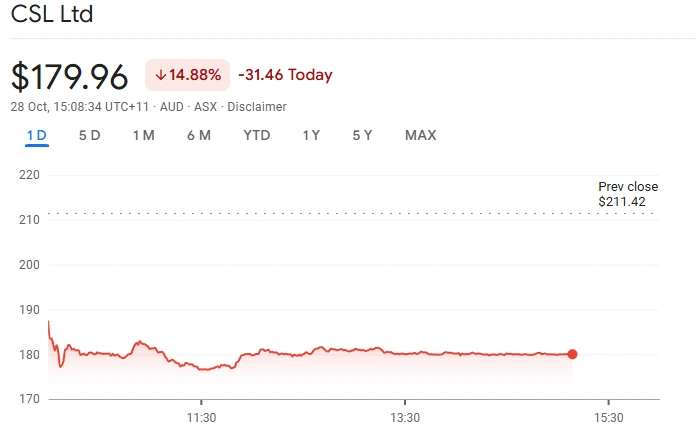

Financial and Market Implications

The drop in vaccination rates has dealt a significant blow to Seqirus, whose revenue for fiscal 2025 was approximately US$2.2 billion. Influenza vaccine sales form a key part of CSL’s revenue and profit streams. The company also pointed to declining demand for albumin, a blood plasma product, in China due to government cost-control measures. These factors collectively weigh on CSL’s broader financial performance. CSL’s shares closed at $176.23, down 17% on the day, marking the lowest price since December 2018 and representing a 36.1% decline year-to-date.

Investor Response and Corporate Governance

The adverse market reaction reflected investor frustration with CSL’s recent performance and strategic challenges. At CSL’s annual general meeting in Melbourne, shareholders voted against the executive remuneration report for the second consecutive year, handing the board a “second strike.” The remuneration report received only 57.1% support, well below the 75% threshold required. Nonetheless, the board survived a spill motion. Chairman McNamee acknowledged shareholder disappointment but expressed confidence in CSL’s long-term strategy and ability to deliver returns.

Also Read: WiseTech Global Shares Crater as Regulators Raid Offices in Share Trading Probe

Strategic Outlook

Despite the setbacks, CSL affirmed that the long-term strategic direction for both CSL and Seqirus remains unchanged. The company maintains that separating Seqirus continues to be the preferred approach, but it will only proceed when shareholder value can be maximised. CSL is focusing on navigating the current volatility in the U.S. vaccine market while progressing its broader restructuring efforts, which include streamlining research and development activities and implementing substantial cost savings.

Summary

The significant drop in CSL’s share price and revised financial outlook highlight the impact of external market headwinds, particularly a sharp decline in U.S. influenza vaccination rates. The postponement of Seqirus’s spin-off and cuts to profit forecasts have intensified investor concerns about the company’s near-term performance. CSL faces challenges from shifting public health policies and growing vaccine scepticism in key markets. The company’s ability to adapt its strategy and restore confidence will be critical in the months ahead.

This update comes as CSL navigates a complex healthcare environment, underscoring the broader disruptions in the pharmaceutical and biotech sectors driven by changing vaccine attitudes and regulatory uncertainties. Investors and market watchers will closely monitor CSL’s next steps in managing the vaccine division and stabilising its financial outlook