In a significant move that could reshape the digital economy, President Donald Trump signed the GENIUS Act into law on Friday, marking the first primary federal legislation aimed at regulating cryptocurrency.

At the heart of the bill is a push to make stablecoins—a type of cryptocurrency tied to traditional assets like the U.S. dollar—easier to issue, use, and regulate. The idea is to give both banks and consumers more confidence in this rapidly growing corner of the financial world.

Standing at the White House during the signing ceremony, Trump called it a “game-changing moment” for America’s financial future.

“We’re bringing back American leadership, and we’re making the United States the crypto capital of the world,” Trump said. “That’s what this law is about.”

President Donald Trump signs the GENIUS Act at the White House on July 18, 2025

From Skeptic to Crypto Cheerleader

Trump’s signing of this bill marks a complete turnaround from his earlier days as a crypto skeptic. Not long ago, he was calling Bitcoin “a scam.” Now? He’s openly embracing digital currency.

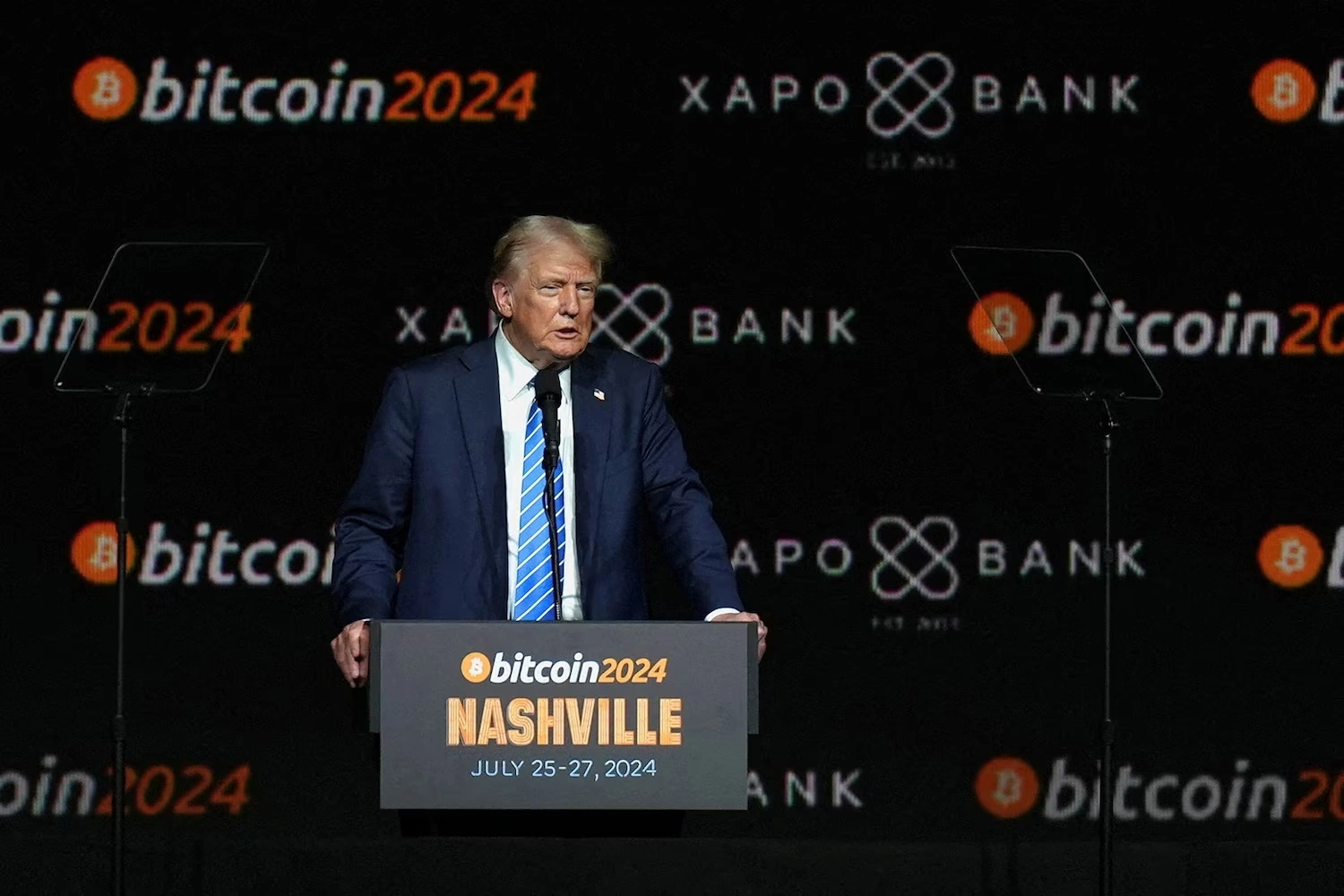

In fact, Trump has recently become heavily invested in crypto. Earlier this year, he launched his meme coin, has spoken at cryptocurrency conferences, and has called crypto “a powerful industry that America should lead.”

With the stroke of his pen on Friday, he made it official: the federal government is finally setting some ground rules for digital currency.

So What’s In the Law?

The GENIUS Act, short for Guiding Emerging National Innovations in U.S. Securities, focused primarily on stablecoins. These are cryptocurrencies that don’t swing wildly in value because they’re tied to something stable, like the U.S. dollar. Think of it like digital cash, but backed by real-world money.

Before this law, stablecoins operated in a somewhat gray area. Some people used them to trade other cryptocurrencies, but banks and financial institutions weren’t sure how to get involved. The new law changes that.

Now, banks and approved institutions can issue stablecoins directly, with more apparent oversight from regulators. The goal is to make stablecoins safer for everyday users while giving the U.S. a leading role in global crypto policy.

Republican Rep. French Hill, who chairs the House Financial Services Committee, celebrated the bill’s passage. “The president asked us to get this to his desk by August, and we did it ahead of schedule,” Hill said.

Not Everyone Is On Board

Of course, no major law passes without controversy. Some Democrats supported the bill, but others raised concerns, especially regarding Trump’s financial ties to the cryptocurrency world.

Rep. Maxine Waters, the top Democrat on the House Financial Services Committee, pointed out that a company linked to Trump’s family recently launched its stablecoin called USD1. The Trump family reportedly owns 60% of World Liberty Financial, the company behind it.

Waters warned that the new law could help boost stablecoins like USD1, potentially benefiting the Trump family directly.

“This bill creates the appearance of regulation but leaves the door open for abuse,” Waters said during the House debate.

World Liberty Financial, for its part, says it is “a private company with no government ties.” Still, the overlap between policy and profit is raising eyebrows in Washington.

What Happens Now?

Although the law has now been signed, don’t expect to see significant changes overnight. Federal agencies have six months to develop the fine print, including detailed rules for managing and monitoring stablecoins.

In the meantime, Trump’s crypto involvement doesn’t stop here. His family is also connected to a Bitcoin mining company and a crypto reserve business. Despite that, the White House says there’s no conflict of interest because Trump’s assets are in a trust controlled by his children.

And the GENIUS Act isn’t the only crypto bill in the pipeline. The House also passed the CLARITY Act, which aims to define how digital assets are classified, specifically whether they are considered securities or commodities. That one is now heading to the Senate for debate.

What This Means for Everyday Americans

So, what does this all mean if you’re not a crypto trader?

The law could make it easier to use stablecoins in everyday life, from online shopping to banking. It could also push more banks to offer crypto-related servicessomething that wasn’t possible before without clear guidelines.

On the flip side, some critics worry that giving politicians and their families ties to crypto companies creates too much room for personal gain.

Either way, one thing is clear: Cryptocurrency isn’t just a niche product anymore. It’s stepping into the spotlight, with federal backing and a whole new set of rules to follow.

As President Trump put it, “This is only the beginning.”

Disclaimer