Lovisa Holdings Limited (ASX: LOV) has delivered a stunning trading update ahead of its Annual General Meeting on 21 November 2025. The Lovisa Holdings trading update reveals global total sales jumped 26.2% in the first 20 weeks of FY26. The fashion jewellery retailer now operates 1,075 stores across more than 50 markets worldwide.

Figure 1: Jewellery Product Collection

The Lovisa AGM 2025 announcement confirms the Company opened 44 net new stores during the financial year to date. This expansion includes 62 new store openings offset by 18 closures, including 6 relocations. The aggressive store rollout strategy has positioned LOV as one of Australia’s fastest-growing retail brands globally.

Store Expansion Strategy Delivers Results

The ASX LOV update highlights comparable store sales growth of 3.5% on FY25 for the 20-week period. This metric demonstrates strong underlying performance beyond network expansion. The Company now trades from 148 more stores than in the same period last year.

Global Chief Executive Officer John Cheston and Group Chief Financial Officer Chris Lauder approved the release. The announcement confirms Lovisa’s strategic focus on expanding its global footprint across all operating markets. The retailer’s store network growth reflects confidence in its fast-fashion jewellery model.

Lovisa Store Network Reaches 1,075 Locations Globally

The Lovisa Holdings trading update confirms the retailer operates 1,075 stores as of November 2025. The network spans more than 50 markets across Asia Pacific, Europe, Americas, Africa, and the Middle East. This represents a significant milestone for the Melbourne-based Company .

The store rollout during FY26 demonstrates Lovisa’s operational capability to execute rapid expansion. The Company opened 62 new stores while closing just 18 locations in the first 20 weeks. This 77.4% retention rate indicates strong site selection and store performance across markets.

Industry Outlook: Fast Fashion Jewellery Market Dynamics

The fast-fashion jewellery market continues to show resilience despite challenging retail conditions globally. Lovisa operates in a niche segment offering affordable accessories with rapid product turnover. The Company ‘s vertically integrated model allows quick response to fashion trends.

Figure 2: Lovisa Retail Store Front

Global jewellery market sizing indicates continued growth opportunities for accessible luxury brands. Lovisa’s expansion across 50+ markets positions it to capture market share from fragmented local competitors. The Company ‘s store network of 1,075 locations provides scale advantages in sourcing and logistics.

Understanding LOV’s Revenue and Profitability Trajectory

Revenue reached AUD 798.1 million for the year ended 29 June 2025, up 14.2% on FY24. Gross profit increased 15.7% to AUD 654.7 million with gross margin expanding to 82.0%. Earnings before interest and tax rose 8.2% to AUD 138.7 million.

Figure 3:Consistent upward revenue trajectory

Net profit after tax grew 4.8% to AUD 86.3 million with basic earnings per share at 78.1 cents. The Company paid total dividends of AUD 96.3 million during FY25. This included a final ordinary dividend of 37.0 cents per share and interim dividend of 50.0 cents per share.

Lovisa’s Geographic Expansion Strategy Explained

The Company opened 162 new stores during FY25 across all regions. This included 86 stores in Europe, 42 in the Americas, 17 in Asia Pacific, and 10 in Africa/Middle East. Seven new franchise stores opened in South America, Africa, and the Middle East.

Lovisa entered one new Company -owned market during FY25, opening its first store in Zambia. The global footprint now includes 38 franchise stores alongside Company -owned locations. This expansion strategy balances capital efficiency with market penetration across diverse geographies.

What’s Next for Lovisa After This Trading Update?

The Lovisa AGM 2025 update confirms continued momentum in the first 20 weeks of FY26. The 26.2% sales growth significantly outpaces the store network expansion rate of 13.8%. This indicates strong revenue per store contribution from new locations.

Management maintains focus on expanding the global store footprint across all operating markets. The Company ‘s proven store rollout capability and vertically integrated model support ongoing expansion. Capital expenditure of AUD 55.2 million in FY25 funded new stores, refurbishments, IT systems, and supply chain infrastructure.

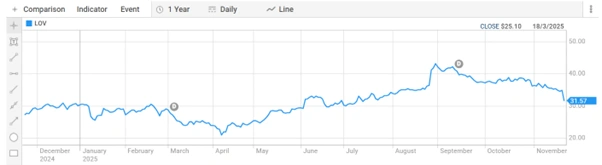

How Is LOV Stock Performing in November 2025?

Lovisa Holdings shares trade at AUD 31.530 per share as of 21 November 2025. The stock has traded in a 52-week range of AUD 20.230 to AUD 43.680 per share. Market capitalisation stands at AUD 3.85 billion, reflecting investor confidence in the growth strategy.

Figure 5: LOV Share Price Performance

The share price response to the Lovisa Holdings trading update will indicate market sentiment on the 26.2% sales growth. Investors will assess whether the comparable store sales growth of 3.5% justifies continued store expansion investment. The Company ‘s track record of profitable growth supports the current valuation.

FAQs

Q1: What was Lovisa’s sales growth in the first 20 weeks of FY26?

Global total sales increased 26.2% on FY25 for the first 20 weeks of FY26.

Q2: How many stores does Lovisa currently operate?

Lovisa operates 1,075 stores across more than 50 markets globally as of November 2025.

Q3: What was Lovisa’s comparable store sales growth?

Comparable store sales grew 3.5% on FY25 for the 20-week period.

Q4: How many net new stores did Lovisa open in FY26 to date?

The Company opened 44 net new stores, comprising 62 new openings less 18 closures.

Q5: What is Lovisa’s current share price?

LOV trades at AUD 31.530 per share with a market capitalisation of AUD 3.85 billion.