Imagine opening a unique startup in India with your capital amount. As the business starts to move vertically, your investment funds come into play. Now, searching for an ideal platform to make an investment deal is challenging. If you are a business owner or an aspiring person, ready to open a venture, then you have landed in the right place.

PRESENTING BEFORE YOU – THE SUCCESS STORY OF AN ONLINE STARTUP, LETSVENTURE BY SHANTI MOHAN, CENTERED ON HELPING OTHER INDIAN COMPANIES, AT TIMES OF INVESTMENT.

CONNECTING ENTREPRENEURS AND INVESTORS OFFLINE VIA THE ONLINE MODE

In 1998, a young woman dreamt of becoming an entrepreneur by opening a startup. She faced a lot of difficulties during the phase of seed financing the business. This event impacted her personally. Thus, after gaining successful experience on-field, she came up with the idea of helping other entrepreneurs like her.

In 1998, a young woman dreamt of becoming an entrepreneur by opening a startup. She faced a lot of difficulties during the phase of seed financing the business. This event impacted her personally. Thus, after gaining successful experience on-field, she came up with the idea of helping other entrepreneurs like her.

LetsVenture laid strong foundations in May 2013 by Shanti Mohan.

“WE’VE BROUGHT DOWN THE TIMELINE FOR FUNDING FROM 4-6 MONTHS TO ABOUT 6-8 WEEKS THROUGH LETSVENTURE!” – QUOTED BY THE CEO

Owing to her past business challenges, today, Shanti is more like a mentor to upcoming Indian startups. And she helps founders become successful entrepreneurs by:

- Linking the startup owners with respective investors.

- Making first-time entrepreneurs connect with Global Angels, Venture Capitalists, and other startup programs.

- Focussing on the growth-stage of startups primarily.

Famous startups such as Drivezy, Explara, Bobble.ai, Ketto, Adpushup, Daily Ninja, etc. are some of their renowned brands the company has closely worked with many.

You can also be a part of this foundation, by creating a free profile on their official webpage. The notable aspect here is that if in case an investor is unable to locate a partner, Shanti’s team is going to help the investor.

You can also be a part of this foundation, by creating a free profile on their official webpage. The notable aspect here is that if in case an investor is unable to locate a partner, Shanti’s team is going to help the investor.

“I REALISED THAT, FOR THE ENTREPRENEURS, IT WAS ABOUT WHO THEY KNEW RATHER THAN WHAT THEY KNEW. IT WAS VERY HARD TO FIND THE RIGHT INVESTOR FOR THE START-UP”, SAYS SHANTI

WHAT’S MORE?

The startup owner is given the blue moon opportunity of interacting with prominent board members and advisors. These include Ratan Tata, Anupam Mittal, and Mohandas Pai.

So, by joining platforms like LetsVenture, your business will turn fruitful on multiple aspects including higher ROI, enhanced financial planning, better accessibility with market professionals, and more.

Moving to the climax of this story, check out the following data covered on the financial claims and raises of LetsVenture. This will come in handy when your startup demands to fundraise, and you will also get to know which investor suits you at that time.

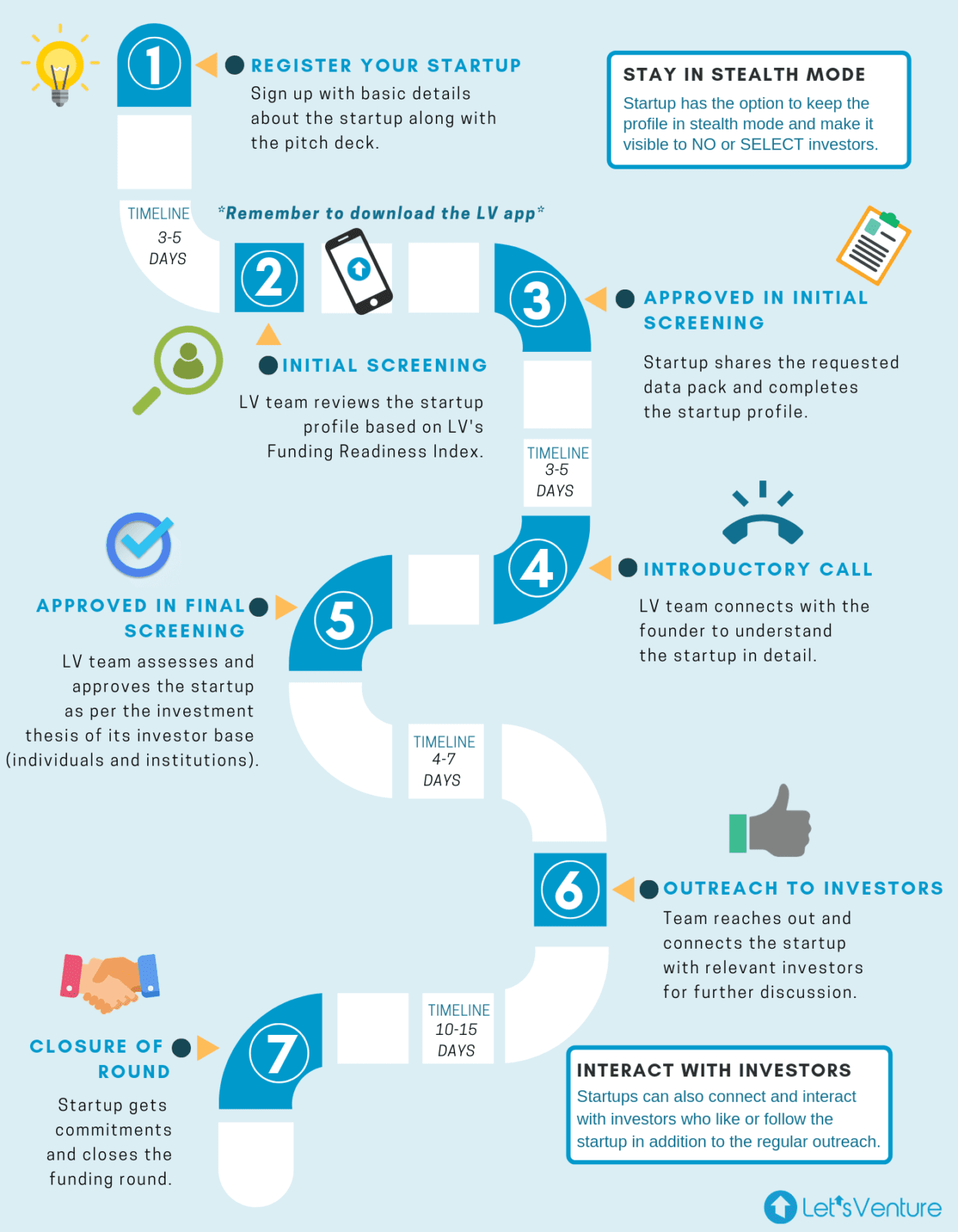

BEHIND THE SCENES ON HOW LETSVENTURE WORKS

Did you know that more than 6500 global investors and 5400 startups from 55 different countries have registered on LetsVenture? 120 micro-funds and 150 family offices also join the partnership.

Did you know that more than 6500 global investors and 5400 startups from 55 different countries have registered on LetsVenture? 120 micro-funds and 150 family offices also join the partnership.

LetsVenture had its best quarter from January to March in 2020. Furthermore, 26 different startups were funded by this platform. The remarkable part here is that Shanti’s brand is an investment fund alternative.

A few recent investments activities notably from LetsVenture:

- The ‘Angel Round Ameliorate Biotech’ transaction was done on June 9th, 2020.

- Seed Round – Eggoz – Fresh and Healthy Egg Brand raised an amount of ₹25M on May 18th,

The total amount of funding is $670K. The company made about 85 different investments with 27 lead investments

BUT HOW DO THEY ACHIEVE THESE NUMBERS?

“OUR INVESTOR IS TYPICALLY THE NEXT GENERATION LEADER OF A FAMILY BUSINESS, AN ENTREPRENEUR, A CXO AND THE GLOBAL INDIAN”, QUOTED THE CEO

- The brand funds other startups by receiving financial support from many Angel Investors globally.

- The money provided is used to expand and rope in other investors into their platform.

- The team gets new investors on-board at a regular time interval including Ritesh Malik from Pepper Content, Purple Style Labs, Pesto Tech, and more. The fundraising value ranges from $2M to INR 22M.

And this is how Shanti’s LetsVenture facilitated investment schemes totaling a value of $85 million so far in 2019.

Therefore, the moral of the story is both the investor and the startup founder are getting benefitted through the team of LetsVenture. Adding to this benefit, the startups are also given special attention and forwarded to experts on-field to review and assess the business plans. This way, even the low-bar founders can rise and prove excellence.

YOUR ROAD AHEAD: THE FUTURE PERSPECTIVE OF INVESTMENT IN BUSINESS

India is turning into a hub for e-commerce platforms and other technology-based modules. However, the basic procedure of fundraising might be a challenge for many entrepreneurs.

Founding your own startup should be a journey you need to commit for a long haul – entrepreneurship is a marathon, not a sprint”, says Shanti

Did you notice that even LetsVenture’s founder Shanti Mohan had issues in the initial business period?

That was during the 90s time but today, as a startup founder, you have all the resources to manage your financial times.

It is estimated that about three times the growth of investors will be accounting for a value of 130 million by 2025 in India. To achieve this number, startup founders should come with innovative ideas to make India a global business hub.

It’s all about time and this is the moment for you to step ahead, research and come up with a business model!

FOOTNOTES:-

Startup Funding: Keeping Up With the Tide

List of top LetsVenture Portfolio Companies

LetsVenture | Tracxn

Domestic Investment In India [/vc_column_text][/vc_column][vc_column width=”1/6″][/vc_column][/vc_row]