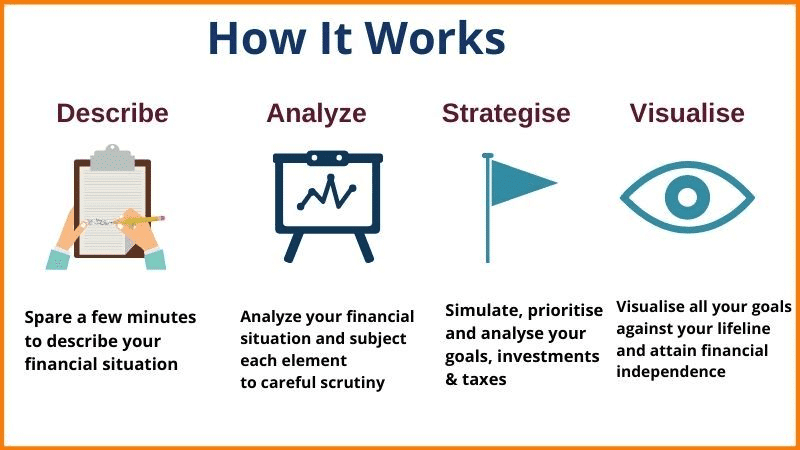

Confused about your start-up finances? Know the thick and thin about the process of financial planning and plan your business budget with this article and take a leap ahead.

What is Financial Planning for Start-ups?

When we say OLA is 6.5 Billion USD, some might not understand what it is. Similarly even the term “Financial Planning” might sound like jargon to some. Well, it’s all about first-timers in the business market or what you call “Budding Entrepreneurs”.

Let’s understand this phrase in easy language. You must have watched your parents planning their monthly budget and then spending their salary accordingly. This is a very basic example of financial planning.

To quote we can say, “The Process of Financial Planning is a mission for your business’ vision which includes how the business will meet its financial requirements while generating effective revenue.”

Why do we need Financial Planning?

“This is what will tell you whether the business will be viable or whether you are wasting your time and/or money,” says Linda Pinson, the award-winning author of Anatomy of a Business Plan.

As a new Entrepreneur who has just ideated his Start-up, it’s necessary to have a Business Plan which has a well-defined Financial Plan. If you are going to pitch for investment, the investor might not even read the executive summary but would ask you “DIGITS”. And to tell these digits confidently, you must have planned your cash flow and should be ready with a revenue plan which can meet utmost all adversities. That’s how important it is.

On a broader prospect financial planning tells you:

- Income

- Cash flow

- Capital

- Investment

- Assets

- Savings

- Financial Understanding

- Success Rate

Hence this is where you get an insight into what’s going wrong and what’s actually working for your start-up.

Is the Process of Financial Planning related to Wealth Management?

Often when we talk about financial planning, people confuse it with wealth management. Wealth management is done for millionaires and billionaires in which someone is in charge of managing their expenses in order to save the existing wealth and look for greater opportunities that can multiply the existing wealth.

While on the other hand financial planning is for everyone and it focuses on how to become self-sufficient, where to invest, how to get funds, budgeting, cash flow strategies and everything related to day to day business aspects.

The process of Financial planning focuses on your business or your day to day aspects of your cash while wealth management is an individual construct which deals with preserving wealth that can be an asset.

So we understand that financial planning leads you to become a millionaire and wealth management will help you preserve these millions and look for greater deals to multiply this. Both are related but both are different.

How to do Financial Planning?

Now that we have understood what is financial planning let’s focus on how to do it for your startup. Here are the following steps which can prepare you for your process of financial planning: You can learn about different factors about what do successful startups do differently then the ones that fail, but here we will talk about just the importance of financial planning.

The Start:

Let’s start from scratch. To start your own start-up, you need to be aware of:

Infrastructure: It includes your office cost, rental charge, purchase of store or warehouse, furniture, machinery, computers etc. You need to be particular about the business location of how much you can afford and what’s required as per your current situation.

Marketing: All your promotional activities whether offline or online need money for which you need funds. Be sure of your audience and look for long term benefit options.

Documentation and Licensing: Expenses of attorney, permits, licenses, insurance deposits and account set up fee, fall under this category. It is important and has to be done urgently.

Expense Estimate:

Be mindful of your monthly expenses as they might seem meagre but can consume all your funds at once if given a free hand. This will give you an estimate of how much more funds are required. Following are a few expenses that need to be checked:

Employees salary

Rent

Bills

Utilities

Loan payment (if any)

Advertisement costs

Miscellaneous etc.

Sales Estimate:

Know how much you can earn monthly. It’s difficult to have an estimate of sales as to how much profit your new business start-up will make, so we can divide it into three categories:

The best case when the business makes the most profitable sales

Worst case when the business makes the least sales

The third category is when your sales lie in between these two

Cash Flow Statement:

Combine total expenses with total costs, total sales and collection each month for a complete budget. This budget is often termed as working capital for your start-up. It tells investors what is your budget and what you expect from them. He is always curious to know how you will generate positive cash flow, how will you bear your bills and salaries of your people keeping in mind that you will be strict with your expenditure and will generate more profit.

Cost Worksheet:

This worksheet contains all that you’ll need to kick-start your business on the first day. It shows the complete purchase, so make sure you have included all the relevant things and have taken an overestimate so that you don’t feel a shortage of money at the start.

Beginning Balance Sheet:

The balance sheet is a technical thing and might scare some people. You’ll need accountants to maintain this spreadsheet every day. It contains the record of your assets, funds owed to investors and investment that you have put in. Whether you have credited to your budget or debited, everything is crystal clear in a balance sheet.

Break-Even Analysis:

Break-even analysis is for investors to show them when exactly your start-up will start generating profit. It’s a growth graph which tells how positive cash flow will happen over time. Whether you are selling products or services, your startup should have a formulated break-even analysis.

Funds Statements:

This statement tells how much profit you expect at the end of the year and how much fund you need to borrow and from where. Just like any other millionaire you can have mention of sources and uses of funds in your annual report to portray your investor or creditor working capital and basic fund needed for your business.

Profit and Loss Statement:

After you are done with all your expenses and estimates, have a profit and loss statement at the end of the day. It is crucial hence most business developers keep a daily record and go till monthly profit and loss statements or yearly maybe. Maintain the spreadsheet as at the end it can also tell you the amount of tax you’ll have to pay and the success rate of your startup.

Are Financial Planners worth it?

It is recommended to have a mentor or advisor for your finances. You can hire someone or trust someone whom you know is best.

Be mindful if he is trustworthy as disclosing your assets to him is like showing him the backbone of your start-up.

In the business, world opportunities don’t knock your door twice so don’t risk your finances by not having a financial planner as he is the one who will take you through even the worst of times and ensure that you are in profit every time and even if there’s a negative cash flow, it brings positive returns.

Conclusion

By now you must have understood that it’s not just investing some lakhs of money and starting your business.

There’s more to it and to make crores from these lakhs, good decision making is required, that’s where the process of financial planning will make you outshine other competitors.

Streamline your finances and kick-start your start-up without getting scared of what you’ll do if you go in loss because financial planning is your SURVIVOR.