140m high-grade mineralisation strengthens Mangaroon project’s global critical minerals potential

Dreadnought Resources Ltd (ASX:DRE) has confirmed a significant new rare earth discovery at its 100%-owned Mangaroon Critical Metals Project in Western Australia’s Gascoyne region.

The Company announced that diamond drilling at the Stinger niobium deposit intersected 140 metres at 0.9% total rare earth oxides (TREO) with a high neodymium-praseodymium (NdPr) ratio of 24%. The find, made during a metallurgical drilling program, highlights the potential of the Gifford Creek Carbonatite complex as one of the largest undeveloped critical mineral systems globally.

Managing Director Dean Tuck said the discovery confirms Gifford Creek’s importance as a world-class carbonatite complex.

“The discovery of thick mineralised rare earths underneath Stinger is yet another example of the shallow, high-grade potential at Gifford Creek.”

Key Findings

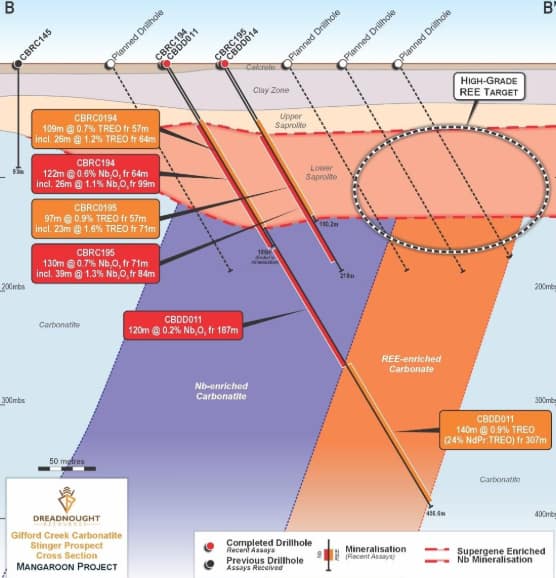

The discovery was made in drill hole CBDD011, which cut through a rare earth carbonatite not previously identified at Gifford Creek. Mineralogical similarities were noted with the Mountain Pass deposit in the United States, one of the world’s most significant rare earth producers.

Figure 1: Diamond drilling at Stinger intersected 140m of rare earth mineralisation

Key intercepts and results include:

- 140m @ 0.9% TREO (24% NdPr:TREO) from 307m.

- Weathering may upgrade grades by 3–6 times, enhancing near-surface potential.

- Barium and strontium enriched carbonatite intersected, marking a new mineralisation style at Mangaroon.

- Ongoing mineralogical work underway at the Australian National University.

Previous drilling has already delivered strong niobium and phosphate grades in twinned holes, supporting the project’s multi-commodity potential.

Economic and Strategic Benefits

The discovery comes as global demand for rare earths intensifies. NdPr, essential for permanent magnets used in electric vehicles and wind turbines, remains a critical supply chain priority for Western markets.

Tuck highlighted increasing commercial interest in the project:

“There is a rebounding market sentiment for critical metals, and we have been receiving an increasing amount of inbound commercial interest.”

Carbonatite specialist Ross Chandler emphasised the broader implications:

“The identification of Ba-Sr-enriched calcite carbonatite at Mangaroon opens up a new search space for both primary and weathered REE mineralisation.”

The economic potential is reinforced by the likelihood of weathering upgrades, which could significantly enhance ore grades and project economics.

Resource and Exploration Updates

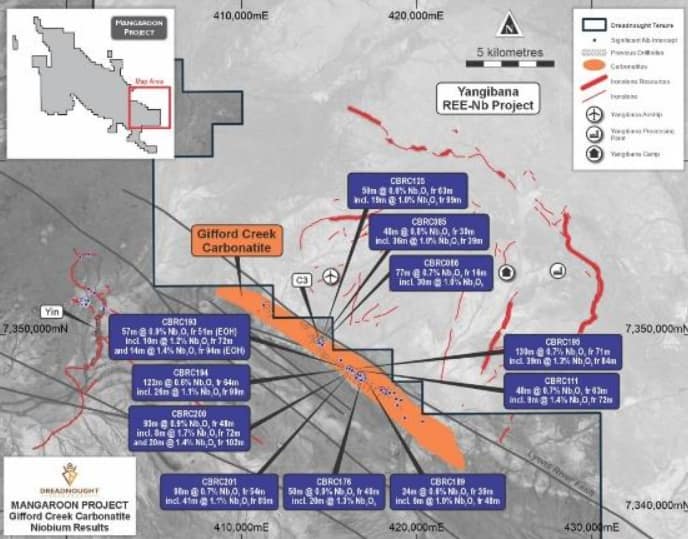

The Mangaroon project spans approximately 5,000 square kilometres and includes multiple discoveries since 2020. At Gifford Creek, resources and targets already established include:

- 30.0Mt @ 1.04% TREO resource at the Yin Ironstone Complex.

- 10.8Mt @ 1.0% TREO inferred resource at the Gifford Creek Carbonatites.

- Significant niobium exploration target at the Stinger deposit.

Figure 2: Map showing the locations of significant niobium intercepts within Gifford Creek

The latest drilling program was partly supported by $180,000 in co-funding from the Geological Survey of Western Australia’s Exploration Incentive Scheme. Metallurgical test work and further drilling campaigns are planned to evaluate both oxide and fresh carbonatite zones.

Market and Strategic Context

Western Australia’s position as a stable mining jurisdiction offers a clear advantage compared to other global rare earth suppliers. The discovery strengthens Australia’s role in diversifying supply chains away from China, which currently dominates global rare earth production.

Forecasts indicate accelerating demand for NdPr and related rare earths due to the growth of the electric vehicle sector, renewable energy technologies, and defence applications. The similarities between Gifford Creek and Mountain Pass suggest Dreadnought Resources could play a pivotal role in meeting long-term supply requirements.

Investor Outlook

Dreadnought Resources shares last traded at $0.041, unchanged on the day, with a market capitalisation of $208.25 million. Trading volumes remain strong, with more than 35 million shares exchanged in the latest session.

Dreadnought Resources shareprice

While the stock has shown volatility in 2025, investor interest is expected to be influenced by ongoing exploration milestones and metallurgical results due later this year. The Company is scheduled to present updates at the Australian Gold Conference in October, with further drilling and study results anticipated in Q4 2025.

Also Read: WA New Rare Earth Deposit 2025: Surprise Breakthrough in WA Mining

Final Thoughts

The discovery of a thick, high-grade rare earth zone at Stinger reinforces the strategic significance of Dreadnought Resources’ Mangaroon project. With multiple critical minerals identified and strong geological parallels to world-class deposits, Gifford Creek is emerging as a key source of rare earth supply for global markets.

As metallurgical work advances and drilling programs expand, Dreadnought Resources is positioned to strengthen its role within the rapidly growing critical minerals sector.

FAQs

1.What did Dreadnought Resources discover at the Mangaroon project?

Dreadnought Resources identified a 140-metre interval grading 0.9% TREO with a 24% NdPr ratio at the Stinger deposit in Western Australia’s Gascoyne region.

2.Why is the Gifford Creek Carbonatite discovery significant?

The discovery expands the project’s rare earth potential and shows geological similarities to Mountain Pass in the United States, a world-class rare earth mine.

3.What resources have been defined at Dreadnought’s Mangaroon project?

Current estimates include 30.0Mt at 1.04% TREO at the Yin Ironstone Complex and 10.8Mt at 1.0% TREO inferred at Gifford Creek.

4.How will rare earth demand impact Dreadnought Resources?

Global demand for NdPr magnets used in EVs, renewables, and defence is forecast to rise, positioning Dreadnought as a strategic supplier.

5.What is the market capitalisation of Dreadnought Resources?

Dreadnought Resources has a market capitalisation of approximately $208.25 million, with shares last trading at $0.041.

6.What are the next steps for the Mangaroon project?

The Company plans metallurgical test work, mineralogical studies, and further drilling programs, with updates expected later in 2025.