Bank CD rates for 2025 are still increasing as investors continue to seek income from safer sources due to policy relaxations and shifting yield expectations.

The most recent figures show that the maximum Certificate of Deposit interest rates 2025 are still as high as 4.1% APY at some banks, whereas the rates at national levels are lower for most of the periods.

Investors are now weighing the short and medium terms to achieve a good mix of liquidity and return, particularly since current CD rates for investors have declined from earlier highs.

Market focus remains on short-term CDs offering yields near 4.1% APY. [Source: Investopedia]

Why Are Bank CD Rates 2025 Still Attractive?

Bank CD rates 2025 offer investors the option of fixed profits that are not affected by the fluctuations in the market, and also provide a very certain income source. Presently, the top-paying CDs of the half-year period have a maximum interest rate of 4.10% APY, whereas the one-year and eighteen-month terms are close to 4% APY at the banking establishments that are the best ones.

The average six-month national rate of CDs is 1.58%, which indicates that there is a huge difference between the best offers and the regular products. This difference in rates promotes shopping around for better rates, especially among investors whose goals are short-term and who are risk-averse.

Bank CD Rates 2025 Support Short-Term Lock-Ins

Some credit unions and online banks are now offering the best rates for short-term deposits, and six-month terms are the highest on the rate tables. Alliant Credit Union is offering a 4.10% APY with a minimum deposit of $1,000, while America First Credit Union and Marcus by Goldman Sachs are offering a 4.05% APY with a minimum deposit of $500.

Bread Savings is also offering 4.05% APY but requires a minimum deposit of $1,500, which is higher than the one at America First Credit Union and Marcus by Goldman Sachs. These products are appropriate for investors who want to have the flexibility of quick reinvestment in case there is a shift in rates again.

Six-month terms dominate the best CD rate rankings in early 2026. [Source: Investopedia]

Should Investors Lock In Certificate Of Deposit Rates 2025 Now?

The investors are considering whether the present levels are worth the commitment for a longer period, especially when the rate cuts are going to affect the future yields.

Two-year CDs at America First Credit Union still reach 4.05% APY, while one-year terms from Marcus, Live Oak Bank, Sallie Mae, Popular Direct, and Alliant Credit Union are offering 4% APY.

Nevertheless, the minimum deposits differ a lot, from $500 to $10,000, which affects the easier access for smaller savers. Investors with bigger balances might choose higher thresholds if the returns are still good.

Bank CD Rates 2025 Reflect Federal Reserve Shifts

The scenario of dropping benchmark rates does not affect the deposit pricing that much, and banks are gradually lowering their headline yields. The Federal Reserve has made the first move in this direction by lowering the federal funds rate.

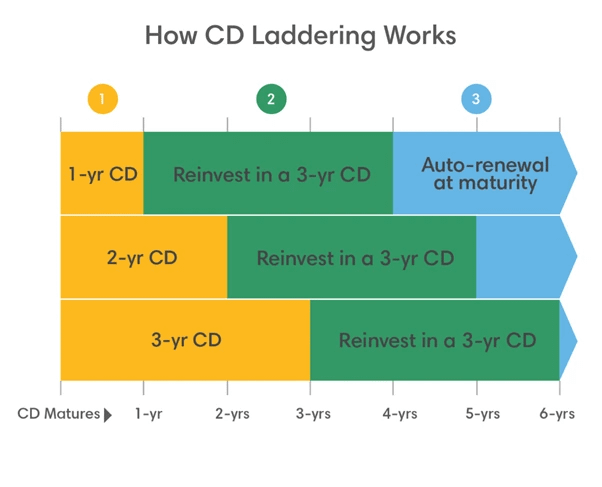

This action limits the period during which high CD returns might be offered. It also helps the strategy of CD laddering, where money is moved into new term CDs when the previous one matures. This is a method of managing the risk of reinvestment and, at the same time, being in the area of competitive yields.

CD laddering helps investors adjust to changing interest cycles. [Source: First Citizens Bank]

Are Current CD Rates For Investors Beating Inflation?

The top CDs are getting pretty close to 4.1% APY, but the pressure from inflation might still be there to eat the real returns up over time. CDs are still better than stocks with respect to safety, but they also miss the chance of long-term investment vehicles that are good at strong growth cycles.

Nevertheless, insured deposits at federally backed institutions up to $250,000 protect principal. For cautious investors, this protection may often be more important than possible higher gains in other places.

Bank CD Rates 2025 Versus Other Savings Options

High-yield savings accounts and money market accounts provide liquidity, but they usually have slightly lower stable returns. Treasury bills are attracting short-term investors who want government-backed flexibility, although the pricing depends on the auctions.

Bonds and mutual funds are exposed to the market, which could be a fitting strategy for higher risk tolerance, or it can just decrease the certainty of capital. Hence, CDs are still important for goal-oriented savings and fixed time horizon investments.

Also read: Silver Price Crash: White Metal Plummets 14% From Record High as Wild Bank Rumors Circulate

FAQs

Q1. What Is A Good Rate For Bank CD Rates 2025?

A1: Rates near 4% APY are considered strong, while top offers reach up to 4.1% APY.

Q2. Are Certificate Of Deposit Rates 2025 Still Falling?

A2: Yes, rates are easing as monetary policy shifts, though select banks still offer elevated yields.

Q3. How Much Do I Need To Open A High-Yield CD?

A3: Minimum deposits range from $500 to $10,000, depending on the bank and CD term.

Q4. Is CD Laddering Useful In 2026?

A4: Yes, it helps investors reinvest at new rates while maintaining steady income access.