A seismic shift is underway in the global rare earths sector. MP Materials (NYSE: MP), the only vertically integrated rare earths element (REE) producer in the United States, has secured a $400 million public-private partnership with the U.S. Department of Defense (DoD). While this headline-grabbing deal boosts American supply chain resilience, it also sends a powerful signal to international markets, especially for those like Europe who currently have negligible rare earths extraction and production.

For Osmond Resources Limited (ASX: OSM), the owner of a high-grade rare earths asset in Spain, the implications are potentially game-changing. As the European Union (EU) races to reduce reliance on China for critical minerals, Osmond’s Orion EU Critical Minerals Project could emerge as a strategic pillar of Europe’s future supply chain.

Figure 1: MP Materials’ deal marks the start of public-private partnerships for critical minerals—will the EU follow?

The MP-DoD Deal: What Just Happened?

On 10 July 2025, MP Materials announced a $400 million investment by the U.S. DoD, making the Pentagon its largest shareholder. The funds will support the construction of the “10X Facility”, a new magnet manufacturing plant to produce 10,000 metric tonnes of rare earth magnets annually by 2028. The DoD has also locked in:

- A 10-year offtake agreement for 100% of magnet output.

- A floor price of USD 110/kg for Neodymium-Praseodymium (NdPr) oxide, nearly twice China’s market rate.

- An overarching framework to accelerate America’s domestic supply chain for electric vehicles, defence systems and renewables.

The U.S. government has effectively underwritten MP’s long-term viability, ensuring security of supply and price stability for its critical sectors.

Figure 2: On 10 July 2025, MP Materials announced a $400 million investment by the U.S. DoD, making the Pentagon its largest shareholder. [Image credit: U.S. Department of Defense]

Why Europe Should Take Note

The EU is lagging in rare earth production. Despite publishing its Critical Raw Materials Act, which mandates that 10% of strategic minerals be extracted domestically by 2030, there is negligible native magnet rare earth production (Nd, Pr, Tb, Dy) and no large-scale rare earth mining underway.

But the need is growing, especially after China cut REE exports earlier this year, triggering a 75% drop in magnet rare earth supply and disrupting European EV and defence manufacturers.

Europe is now staring down the same supply chain vulnerabilities that the U.S. moved decisively to fix. The MP-DoD deal is not just a policy moment; it’s a model that Europe will need to adopt.

Osmond Resources: Europe’s Strategic Contender

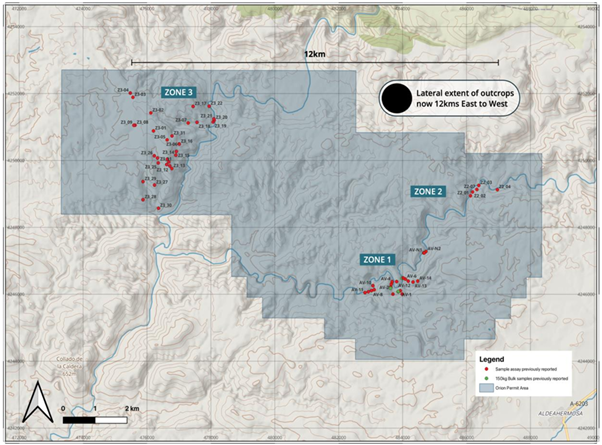

Now turning attention to Osmond Resources, which owns the Orion EU Critical Minerals Project located in southern Spain. The Project covers 228 km² following a major expansion and contains multiple heavy mineralised layers rich in Nd, Pr, Dy, and Tb—the very same rare earths that the Pentagon has just prioritised.

What sets Osmond apart?

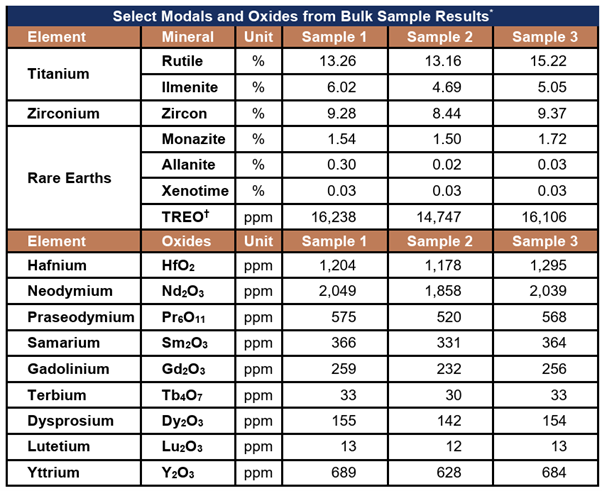

- High-grade TREO: Bulk samples confirm Total Rare Earth Oxide (TREO) grades over 1.5%, which is among the highest globally at this stage of development.

- Two additional economic minerals: In addition to magnet rare earths, Osmond could potentially have the highest grade rutile (titanium) and zircon / hafnium project globally (both strategic critical raw materials in the EU).

- Mineralisation confirmed in outcrops across a 12km lateral extent, highlighting the high-tonnage scale and high-value potential.

- Drilling-ready: A 15-hole maiden drilling program is scheduled for the current quarter to confirm mineralisation continuity and scale potential.

- EU location: Situated within the EU’s industrial core, reducing permitting and shipping timelines.

Figure 3: Osmond’s Orion EU Critical Minerals Project spans three prospective zones across 228 km² in southern Spain.

Strategic Minerals with a Strategic Location

Osmond is positioned in Jaén Province, Andalucía, close to key European battery and defence supply chains. This matters because the EU’s Critical Raw Materials strategy is not just about mining; it’s about geopolitically aligned supply.

European Commission Executive Vice-President Stéphane Séjourné recently stated:

“All European countries today have strategic reserves for oil and gas. We should do the same for strategic raw materials.”

The EU has already introduced subsidies and investment mechanisms for battery and semiconductor projects. Magnet Rare earths are next in line, and Osmond is one of the few owners of assets within the EU with a high-grade, scalable, and policy-aligned potential. The image below shows the modal and oxide composition of bulk samples collected from Osmond Resources’ Orion Critical Minerals Project in Spain. These results highlight significant concentrations of high-value rare earth elements such as Neodymium (Nd₂O₃), Praseodymium (Pr₆O₁₁), and Dysprosium (Dy₂O₃), alongside strategic minerals like rutile, zircon, and hafnium. The consistently high TREO (Total Rare Earth Oxide) values—exceeding 14,700 ppm (1.47%) across all three samples—underscore the Project’s potential as a world-class critical minerals source within the EU.

Figure 4: Bulk sample results from Osmond Resources’ Orion Project showing high concentrations of key rare earth elements and strategic minerals.

Comparing Osmond to MP Materials

MP’s project in California started as a mine. It took over a decade to reach full supply chain integration, including separation, metallurgy, and magnet production. Osmond, however, has the advantage of policy clarity, investor interest, and market precedent.

| Feature | MP Materials | Osmond Resources |

| Jurisdiction | U.S. | EU (Spain) |

| Backing | $400M from U.S. DoD | Poised for EU support |

| Grade | Proven Reserves ~4.0% TREO | >1.5% TREO in bulk samples >13% Rutile >8% Zircon >1,200ppm Hafnium |

| Magnet Minerals | Nd, Pr | Nd, Pr, Dy, Tb |

| Stage | Operating and expanding | Historical confirmation of opportunity with drilling in Q3, CY25 and then fast-tracked Scoping Study |

With high-priority magnet rare earth elements like Nd, Pr, Tb and Dy confirmed in assays, Osmond’s material is ideally suited for magnet production, particularly for Europe’s rapidly growing EV and wind turbine sectors.

Next Steps: Drilling and Scoping Study

Osmond is accelerating its roadmap. The upcoming 15-hole drilling campaign will aim to confirm the scale potential through mineralisation continuity and depth of high-grade seams across the three zones. Simultaneously, metallurgical test work is progressing at SGS Labs in Canada to develop a flowsheet that will fast-track a Scoping Study by 1H, CY2026.

This is a tightly managed timeline, designed to synchronise with expected EU funding and policy updates in early 2026. Osmond’s cash reserves of $4.3 million provide breathing room to deliver these milestones.

Additionally, the Company is exploring monetisation pathways for its quartz-rich waste stream, potentially supplying silicon metal, another Strategic Critical Material in the EU.

Investor Outlook: An EU MP Moment?

MP Materials’ share price surged 50% following the DoD deal. While Osmond is still at the early stages, the setup is strikingly familiar:

- High-grade, high-value and high-tonnage potential for strategically aligned critical minerals.

- Located in a market desperate for domestic supply.

- Clear regulatory tailwinds.

- A proven development roadmap.

If the EU follows the U.S. model and introduces price floors, offtake guarantees or direct investments, Osmond could be one of very few companies ready to absorb and scale that support.

Final Word

The MP Materials–DoD agreement is a global wake-up call. It shows what’s possible when national security, industrial strategy, and resource development align.

Osmond Resources is standing at a similar crossroads. With a high-grade European project, aligned with urgent policy goals and proven demand, it represents not just a strong exploration story but a potential strategically significant asset for the EU.

As the continent grapples with how to secure its rare earth future, Osmond is already holding the keys.

Key Takeaways:

- Osmond’s Orion EU Critical Minerals Project boasts very high TREO, rutile, zircon and hafnium grades and a strategic location in Spain.

- Europe’s lack of rare earth extraction makes Osmond a critical asset in waiting.

- The MP-DoD deal sets a global precedent that the EU may replicate.

- With drilling imminent and a Scoping Study planned, Osmond is building momentum at the right time.