SLAM Exploration is a junior resource company based in Miramichi, New Brunswick, led by their CEO Mike Taylor. The company was established in 1996 and had a registered capital of under CAD 5,000,000. The company’s portfolio consists of properties that are rich in gold, silver, base metals and rare earth elements. The Company is generating revenues from property sales and has a PE (Price-Earnings) multiple of 8.8.

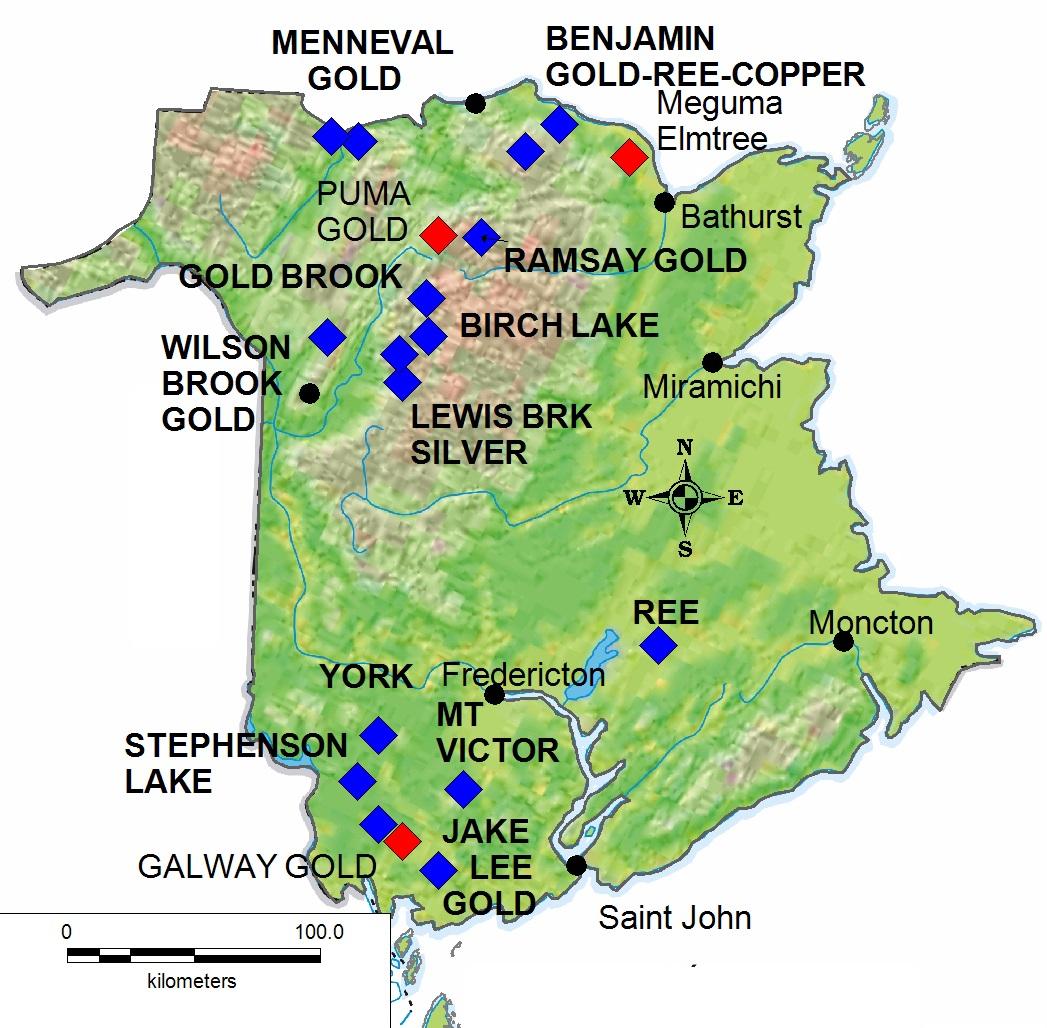

SLAM Exploration Gold, Silver, Base Metal And REE Projects

Since incorporation in 1996, the company has operated as a project-generating resource company using advanced AI, airborne, satellite and geochemical technologies combined with old-fashioned boot-and-hammer methods to drive the acquisition of gold, silver, base metal and rare earth element (“REE”) projects. The Company holds NSR royalties on the Superjack, Nash Creek, Portage, Goodwin, Lower 44 and A’Hearn properties in the Bathurst mining district of New Brunswick. These royalties derive from the sale of properties through which the company has raised significant funds.

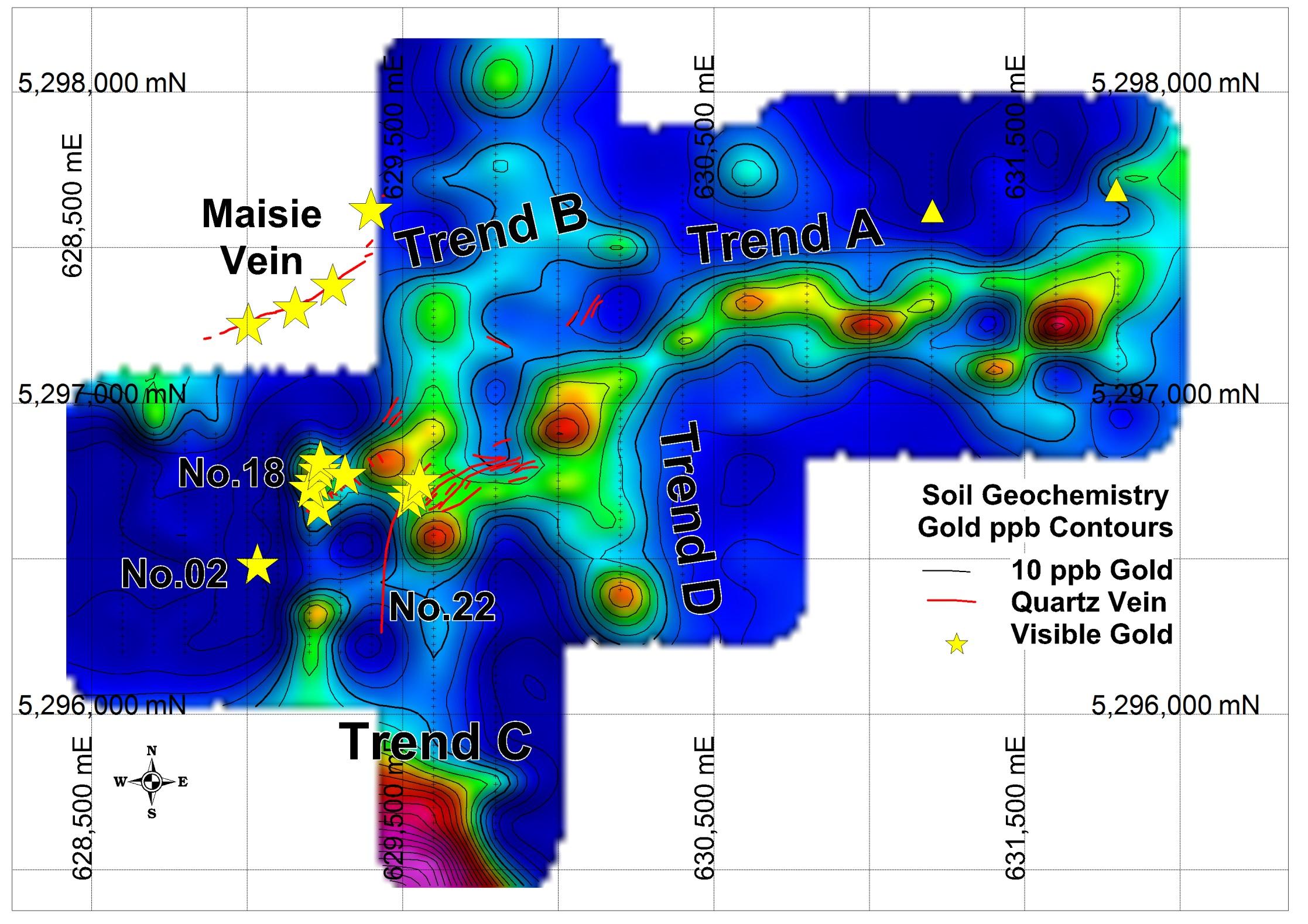

The current focus for SLAM is on gold, primarily its flagship Menneval gold project. The company found a swarm of new gold veins in the 2020-2021 exploration campaign with multiple new gold sites found along the No.02, No. 18 and No 22 veins. SLAM drilled 20 holes in 2021 and intersected core intervals ranging up to 56.5 g/t gold over 0.51 m. The new gold veins are associated with a 2,800 metre long gold anomaly in soils that is largely un-tested by drilling.

The property comprises 572 mineral claim units covering 12,400 hectares located in northern New Brunswick. “Yes, SLAM Exploration owns it completely,” said the CEO, “To date, we have modest expenditures on it but it will soon be time to ramp up. We would like to continue this project to the feasibility stage.”

SLAM owns the Ferguson and Ramsay claim groups adjacent to the Williams Brook gold project where Puma Explorations Ltd. Puma has recently announced significant new gold discoveries in this emerging gold district.

SLAM recently announced the acquisition of the Benjamin River gold and REE property. The company originally staked a small claim for its REE potential, but expanded it to 400 mineral claim units covering 8,534 hectares when research showed the presence of widespread presence of anomalous gold up to 690 ppb in stream sediments surrounding the REE occurrence. Copper was also detected in a solitary drill hole by a previous company in 2014.

SLAM is also involved in the southern New Brunswick gold play where Galway Metals Inc. recently reported significant new gold discoveries and has a resource estimate pending on its Clarence stream gold deposit. The Jake Lee, Mount Victor and Little Mount Pleasant gold properties on the flanks of the Sawyer Brook and Wheaton Bay faults in the vicinity of the Galway gold discoveries.

The Company owns the Gold Brook, Birch Lake gold and Wilson Brook gold properties on similar structures in central New Brunswick. SLAM owns the Keezhik and Miminiska gold projects in Ontario and the Mount Uniacke gold project in Nova Scotia. The Company owns a portfolio of base metal properties in the Bathurst Mining Camp (“BMC”) that is subject to an option agreement.

In an interview, Mike Taylor, the CEO said, “New Brunswick is an emerging gold district as well as a major zinc-producing area. Trevali is operating the Caribou mine and the Brunswick #12 mine was a world class zinc producer that generated 10,000 tons a day over its 50 year mine life. Although our focus is the mineral-rich province of New Brunswick, SLAM has diversified its holdings to include gold projects in Nova Scotia and Ontario.”

The company expects to do more drilling on the swarm of new gold veins discovered in its 2020-21 drilling program at Menneval. This program includes testing the 2,800 metre soil anomaly shown as Trend A below. Trends B and C are also drilling targets. The yellow stars are visible gold sites.

New Gold veins discovered in the 2020-21 drilling program in Menneval

New Gold veins discovered in the 2020-21 drilling program in Menneval

SLAM Holding Key Properties in New Brunswick, Canada

SLAM Holding Key Properties in New Brunswick, Canada

SLAM Exploration has big plans for gold, base metal and REE mineral development in Canada. The image provides an overview of the projects including some very strategic holdings in New Brunswick. Of these projects, the company recently acquired the Benjamin Gold and REE property in February 2022. The acquisition was by staking so the company owns 100% right and title to these mineral claims. The property covers widespread stream sediment ranging up to 691 ppb gold.

SLAM Exploration expects to resume drilling Vein No 18 and other high grade gold veins at Menneval and is planning to continue its aggressive property acquisition and create further opportunities in 2022. The company intends to evaluate significant gold anomalies on its Benjamin, Jake Lee and other wholly owned gold, base metal and REE properties.

SLAM Exploration’s CEO Michael Taylor

SLAM Exploration’s CEO Mike Taylor

CEO Mike Taylor has led the company since its incorporation in 1996. He is a veteran geologist who completed his education at the University of New Brunswick. He was responsible for SLAM Exploration’s discovery of the Maisie gold occurrence in 2012. Since then, the Company has made several high grade gold discoveries including the No 2, No 18 and No 22 veins. The Company has funds in place for additional drilling in 2022.

When asked how they decided to add properties or start new projects, he said, “We research properties that have potential for gold, silver, base metal and REE minerals demonstrated by previous work. We like to acquire drill-ready projects, although they often require preliminary work to validate and locate mineral zones identified by previous workers. There is a motherlode of data available in provincial files of work done in the past by various companies.”

This philosophy is driving organic growth for SLAM Exploration, a fact supported in their financials.

SLAM Exploration Stock Price and Financials

SLAM Exploration stock price saw a steep rise in September and November 2021 although it has seen a recent decline to its current share price of CAD 0.04. The company has shown a 52 week range between CAD 0.03 and CAD 0.13. The company’s current market cap is at CAD 1.88 million. The company currently has 59.7 million shares with an average volume of 131 thousand.

SLAM Exploration current market capitalization is $2,387,151 ($2.4M) with a PE of 8.5 and a close price of $0.04.

The company recently raised CAD 293,000 through private placements. The funding garnered by the company will be used to fund the excavation and mineral mining for Menneval Gold Project.

Why should investors keep a close eye on SLAM Exploration?

Led by a team of well experienced Geoscientists and a highly qualified management team, the company has a very promising future. With a history of timely property acquisition and increasing evaluation the company has built a more than satisfactory shareholder value. Added to that, the company is working hard to find new gold deposits in their properties and acquire new properties to increase the value of their portfolio. The current highlights of the company that should capture investor interests include:

- Benjamin gold and REE acquisition.

- Recent new gold vein discoveries on their flagship project.

- The company has announced the assay results for the last 20 diamond drill holes in January 2022 on the Menneval project. The company found gold in all 20 drill holes.

- The company is currently planning additional drilling to expand these discoveries.

Slam Exploration’s strategic element portfolio

SLAM Exploration has a strategic element portfolio focusing on gold, silver, base elements and rare earth elements. These new developments, especially the recent discovery of veins 18 and 22, show that the company is positioned for success. You can find more information on their LinkedIn profile and their website.

Disclaimer

The content, including but not limited to any articles, news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations and video (Content) is a service of COLITCO LLP and is available for personal and non-commercial use only. The principal purpose of the Content is to educate and inform. The Content does not contain or imply any recommendation or opinion intended to influence your financial decisions and must not be relied upon by you as such. Some of the Content on this website may be sponsored/non-sponsored, as applicable, but is NOT a solicitation or recommendation to buy, sell or hold the stocks of the company(s) or engage in any investment activity under discussion. Colitco LLP is neither licensed nor qualified to provide investment advice through this platform. Users should make their own enquiries about any investments and Colitco LLP strongly suggests the users to seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice), as necessary. Colitco hereby disclaims any and all the liabilities to any user for any direct, indirect, implied, punitive, special, incidental or other consequential damages arising from any use of the Content on this website, which is provided without warranties. The views expressed in the Content by the guests, if any, are their own and do not necessarily represent the views or opinions of Colitco LLP. Some of the images/music that may be used on this website are copyright to their respective owner(s). Colitco LLP does not claim ownership of any of the pictures displayed/music used on this website unless stated otherwise. The images/music that may be used on this website are taken from various sources on the internet, including paid subscriptions or are believed to be in the public domain. We have used reasonable efforts to accredit the source wherever it was indicated as or found to be necessary.