The total global demand for rare earth oxides is expected to increase from 208,250 metric tons in 2019 to approximately 304,678 metric tons by 2025. As of today, China is the world’s largest producer of rare earth elements, accounting for half of the total global rare earth mine production.

However, given the dominance and concern for restrictions on the global supply of rare earth, superpowers like the U.S. want to diversify the sources and suppliers of critical metals outside China. Moreover, the Australian Government announced AUD 500 million ($360 million) in funding for rare earth stocks earlier this year to boost critical minerals’ output and to diversify supply for its allies.

It is an advancement in the Australian rare earth market and expands opportunities for rare earth companies.

What are Rare Earth Elements?

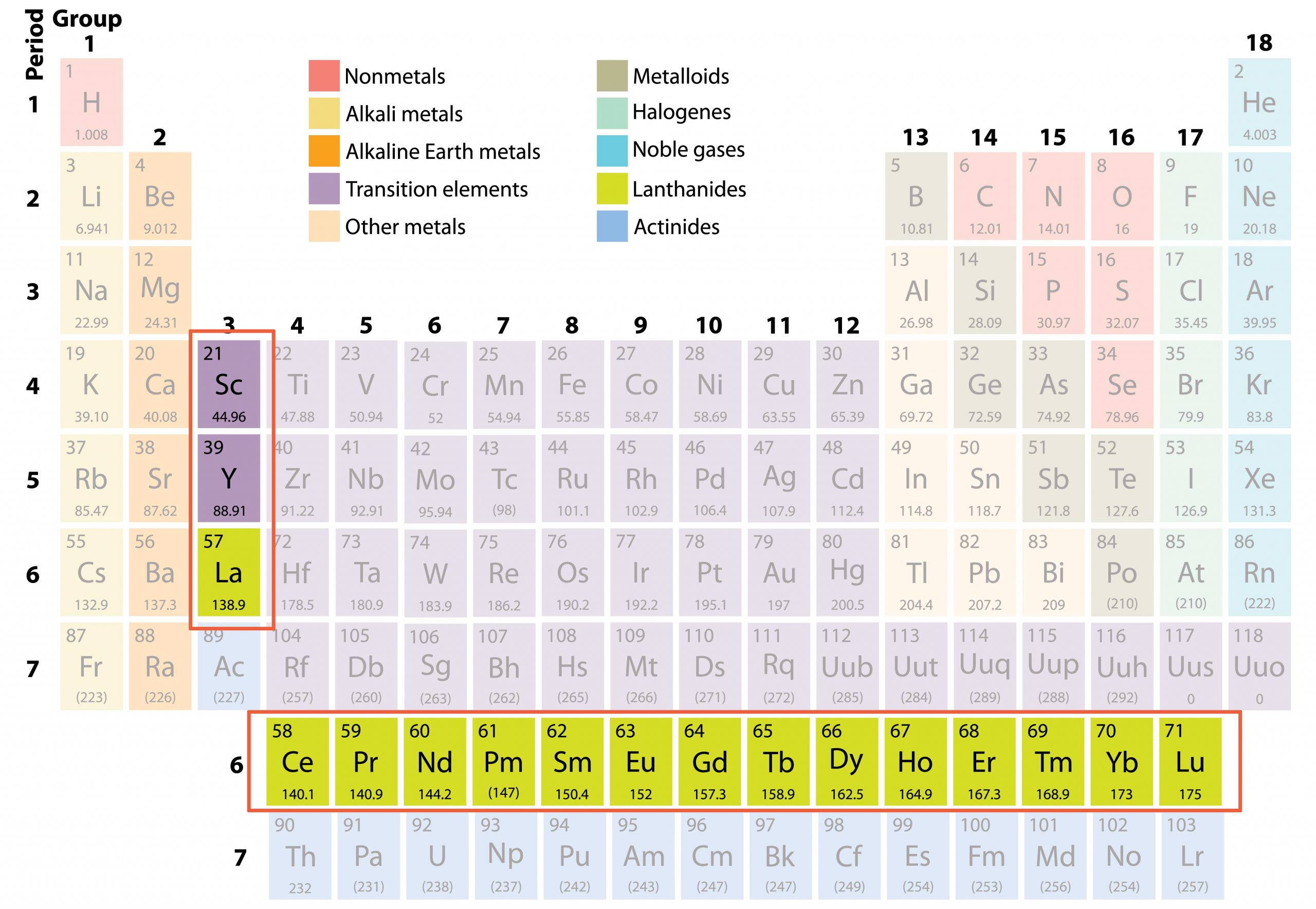

The Rare Earth Elements (REEs) are 17 elements on the periodic table that include Fifteen lanthanides (La–Lu): Lanthanum (La), Cerium (Ce), Praseodymium (Pr), Neodymium (Nd), Promethium (Pm), Samarium (Sm), Europium (Eu), Gadolinium (Gd), Terbium (Tb), Dysprosium (Dy), Holmium (Ho), Erbium (Er), Thulium (Tm), Ytterbium (Yb), Lutetium (Lu), one Scandium (Sc), and one Yttrium (Y).

REE- LANTHANIDES (La-Lu), SCANDIUM (Sc), AND YTTRIUM (Y)

REE- LANTHANIDES (La-Lu), SCANDIUM (Sc), AND YTTRIUM (Y)

Rare earth elements, also known as Rare Earth Oxides (REOs), are soft, malleable, and react at elevated temperatures or when divided. Some REEs have unique magnetic, luminescent, and electrical properties, which is why they are used in various applications.

Today, REEs are used in high-tech devices, such as smartphones, digital cameras, computer hard disks and monitors, fluorescent and LED lights, flat-screen televisions, etc. Larger quantities of REEs are used in clean or renewable energy technologies like photovoltaic (PV) cells, Electric Vehicles (EV), and defence technologies.

Australia, being already the fourth-largest producer of rare earth, now has the possibility of scaling up the industry. Investors can spot more opportunities and expect higher-than-expected positive outcomes from rare earth stocks (metal) in Australia.

Also Read: Top 6 Spots for Lithium Mining in Australia

Top 3 Australian Rare Earth Stocks

Here are the top 3 ASX-listed rare earth stocks in Australia that investors need to consider.

1. Lynas Rare Earths Ltd

Lynas Rare Earths Ltd (ASX: LYC) is one of the largest rare earth processors outside China.

The company has its Lynas Mt Weld mine in Western Australia, considered one of the world’s premier rare earth deposits. Lynas operates the world’s largest single rare earth processing plant in Malaysia, exporting high-quality separated rare earth materials to manufacturing markets in Asia, Europe, and the United States. The company is building its new Rare Earth Processing Facility in Kalgoorlie as a foundation project for the Lynas 2025 growth vision.

Lynas has a market capitalisation of $7,041,466,462 and has issued 905,072,810 shares. The company was awarded $120m by the U.S. Department of Defence for the construction of a U.S. commercial Heavy Rare Earth facility located within an existing industrial area on the Gulf Coast of Texas.

2. Iluka Resources

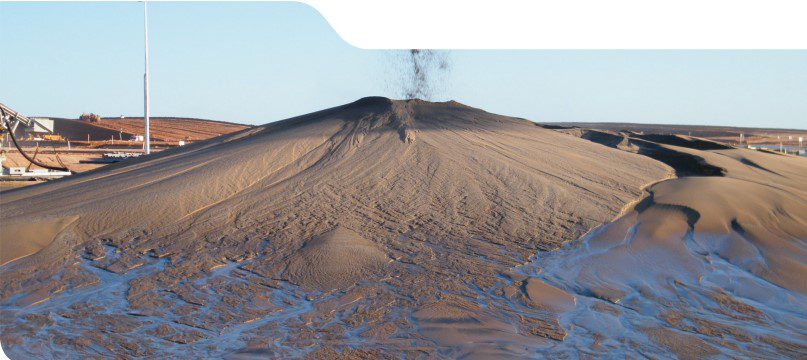

Iluka Resources (ASX: ILU) is an Australian mineral sands company with expertise in exploration, development, mining, processing, marketing, and rehabilitation.

MINERAL SANDS

Iluka’s market capitalisation accounts for $3,964,616,969 and has 424,932,151 shares issued, and is one of the best stocks to invest in Australia.

The company is currently building Australia’s first fully integrated rare earth refinery potential enough to produce both light and heavy rare earth oxides. The company’s rare earth refinery in Australia will provide an independent supply of rare earth oxides, which is currently in demand for electrification and decarbonisation.

3. Arafura Resources

Arafura Resources (ASX: ARU) is an Australian company producing rare earth products. The company is one of Australia’s rare earth metal stocks with promising project portfolios.

NOLANS NEODYMIUM-PRASEODYMIUM (NdPr) PROJECT

The company’s flagship project is the Nolans Project in Australia’s Northern Territory, underpinned by low-risk Mineral Resources potential enough to supply Neodymium-Praseodymium (NdPr).

Arafura Resources has a market capitalisation of $560,485,759 and has issued 1,724,571,565 shares. The company currently seeks to develop the Nolans project that will cover a significant proportion of global demand for the high-performance Sintered Neodymium Iron Boron (NdFeB) permanent magnet market.

Australia has the world’s most reliable and sustainable resource industry, providing critical minerals and rare earth elements. With the necessary support from the Government and private investors, the country will soon become a global critical minerals powerhouse.

Disclaimer

The Content, including but not limited to any articles, news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video (Content), is a service of COLITCO LLP and is available for personal and non-commercial use only. The principal purpose of the Content is to educate and inform. The Content does not contain or imply any recommendation or opinion intended to influence your financial decisions and must not be relied upon by you as such. Some of the Content on this website may be sponsored/non-sponsored, as applicable, but is not a solicitation or recommendation to buy, sell or hold the stocks of the company(s) or engage in any investment activity under discussion. Colitco LLP is neither licensed nor qualified to provide investment advice through this platform. Users should make their inquiries about any investments, and Colitco LLP strongly suggests the users seek advice from a financial adviser, stockbroker, or other professional (including taxation and legal advice), as necessary. Colitco, at this moment, disclaims any liabilities to any user for any direct, indirect, implied, punitive, special, incidental, or other consequential damages arising from any use of the Content on this website, which is provided without warranties. The views expressed in the Content by the guests, if any, are their own and do not necessarily represent the views or opinions of Colitco LLP. Some images/music used on this website is copyrighted to their respective owner(s). Colitco LLP does not claim ownership of any of the pictures displayed/music used on this website unless stated otherwise. The images/music that may be used on this website are taken from various sources on the internet, including paid subscriptions, or are believed to be in the public domain. We have used reasonable efforts to accredit the head wherever it was indicated as or found to be necessary.