Australia is the world’s largest producer of lithium and has the second-largest lithium reserves accounting for 5.7 million metric tons. The majority of the lithium mining in Australia extracts lithium from hard-rock minerals like Spodumene.

Lithium (Li), a soft, silvery metal, is used in different types of products ranging from rechargeable batteries for mobile phones, laptops, digital cameras, and electric vehicles to heart pacemakers, toys, and clocks. This lightest metal is one of the most in-demand metals in the energy sector.

Also Read: Prices At Fuel Pump And Soaring Ev Interest Puts Australian Technology In Prime Position

The Rising Demand for Lithium

Lithium demand for batteries is soaring since it is a key component in rechargeable lithium-ion batteries, used in almost all Electric Vehicles (EV). As per a Mckinsey report, the demand for lithium will rise from approximately 500,000 metric tons of Lithium Carbonate Equivalent (LCE) in 2021 to four million metric tons in 2030.

In terms of future supply, the world will face potential shortages of lithium as early as 2025 and this could be managed only if sufficient investments are made to expand production. Given the demand for lithium, and lithium batteries, it is worthwhile to consider lithium mining in Australia, its current production, and its resource potential.

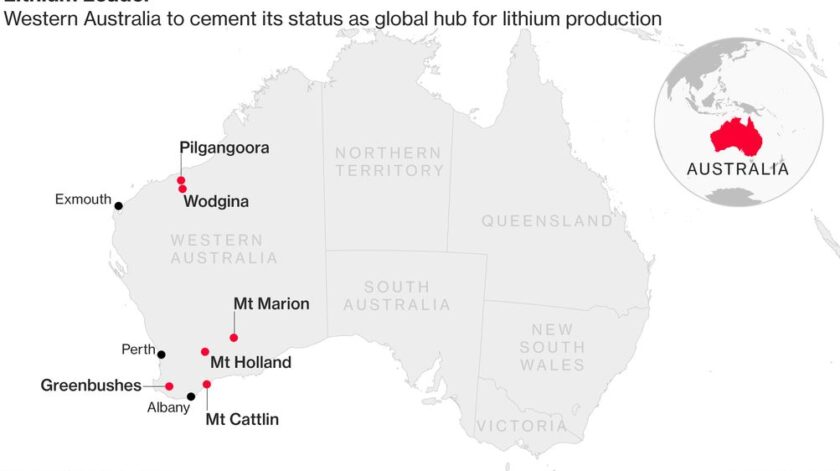

Top 6 Spots For Lithium Mining in Australia

Australia produced 49% of global lithium output in 2020 and is well-positioned to meet the rising demands for metals used in low-emission technologies.

In fact, Western Australia (WA) possesses the majority of Australia’s lithium mining spots. The top lithium mining spots in WA include,

1. Greenbushes Lithium Mine

The Greenbushes mine is the world’s largest hard-rock lithium mine located approximately 250 kilometers south of Perth and Fremantle. The site is the longest continually mined area in WA, with mining operations taking place since 1983.

Greenbushes mine is currently owned by Talison Lithium in a joint venture between Tianqi Lithium and Albemarle. The site produced 135,000 tonnes of spodumene concentrate in 2021.

2. The Pilgangoora Lithium Mine

Pilgangoora mine is located 120km from Port Hedland, Western Australia. The site houses one of the world’s largest hard rock lithium deposits with combined resources of 308.9 million tonnes at 1.14% Li2O, up an incremental 40.7milion tonnes at 0.57% Li2O (suitable for glass, optic, and ceramic applications).

The mining area is owned by Pilbara Minerals, one of the top lithium mining companies in Australia. Pilbara has two processing plants ‘ The Pilgan Plant’ located on the Northern side of the Pilgangoora area and ‘Ngungaju Plant’ located South, both producing spodumene concentrate that has the potential to meet the rising lithium market demand.

3. Kathleen Valley Mine

Kathleen Valley is located about 60 km north of Leinster, and 680km northeast of Perth, Western Australia. The Kathleen Valley mine, one of the upcoming new lithium mines in Australia, houses world-class, high-grade lithium deposits.

The mine is owned by Liontown Resources, a Tier 1 battery minerals producer. Recent studies indicated world-class, high-grade lithium deposits with a Mineral Resource Estimate (MRE) of 156 Mt @ 1.4% Li2O. Liontown will undergo mining operations underground minimizing the lithium mining environmental impact and footprints. Top car manufacturers like Tesla and Ford, have tied up with Liontown for spodumene concentrate supply from Kathleen Valley.

4. Earl Grey/Mount Holland Mine

Earl Grey or the Mount Holland mine in Western Australia is an underdeveloped project in the country. The Earl Grey mine is owned by Covalent Lithium which expects an 85% expected recovery of spodumene and to produce more than 340,000 tonnes of spodumene concentrates each year. Further studies are being performed.

Covalent Lithium with its project and a concentrator at Earl Grey as well as a Kwinana refinery with all set to produce battery-quality lithium hydroxide of approximately 50,000 tonnes per year.

5. Mount Marion

Mt Marion is located 40 kilometers southwest of Kalgoorlie, Goldfields, Western Australia. The site produced about 114,000 tonnes of spodumene concentrate in the year 2021 with production exceeding 485,000 tonnes for the financial year.

Mt Marion lithium is jointly owned by Mineral Resources Ltd (50%) and one of the world’s largest lithium producers, Jiangxi Ganfeng Lithium Co. Ltd (50%).

6. Mt Cattlin Mine

The Mt Cattlin mine is located approximately 2 kilometers North of Ravensthorpe, Western Australia. Mt Cattlin mine produces low-grade spodumene, but the perks of the site include larger volumes of production with lower operating costs in terms of extracting lithium in Australia.

Mt Cattlin mine was initially owned by one of the Australian lithium mining companies, Galaxy Resources Ltd until it was fully acquired by Allkem. Allkem’s Mt Cattlin mine produced 63,000 tonnes of spodumene concentrate at a grade of 5.7% Li2O.

Summing Up

The Australian mining industry was responsible for 10% of the total GDP between 2019 and 2020 and remains a dominant global producer of mined commodities. Given the current status of lithium production and emerging lithium mining companies and new mining sites underway, Australia will stand as one of the world’s lithium-production superpowers in the future.

Disclaimer

The Content, including but not limited to any articles, news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video (Content), is a service of COLITCO LLP and is available for personal and non-commercial use only. The principal purpose of the Content is to educate and inform. The Content does not contain or imply any recommendation or opinion intended to influence your financial decisions and must not be relied upon by you as such. Some of the Content on this website may be sponsored/non-sponsored, as applicable, but is not a solicitation or recommendation to buy, sell or hold the stocks of the company(s) or engage in any investment activity under discussion. Colitco LLP is neither licensed nor qualified to provide investment advice through this platform. Users should make their inquiries about any investments, and Colitco LLP strongly suggests that users seek advice from a financial adviser, stockbroker, or other professional (including taxation and legal advice), as necessary. Colitco, at this moment, disclaims any liabilities to any user for any direct, indirect, implied, punitive, special, incidental, or other consequential damages arising from any use of the Content on this website, which is provided without warranties. The views expressed in the Content by the guests, if any, are their own and do not necessarily represent the views or opinions of Colitco LLP. Some images/music used on this website is copyrighted to their respective owner(s). Colitco LLP does not claim ownership of any of the pictures displayed/music used on this website unless stated otherwise. The images/music that may be used on this website are taken from various sources on the internet, including paid subscriptions, or are believed to be in the public domain. We have used reasonable efforts to accredit the head wherever it was indicated as or found to be necessary.