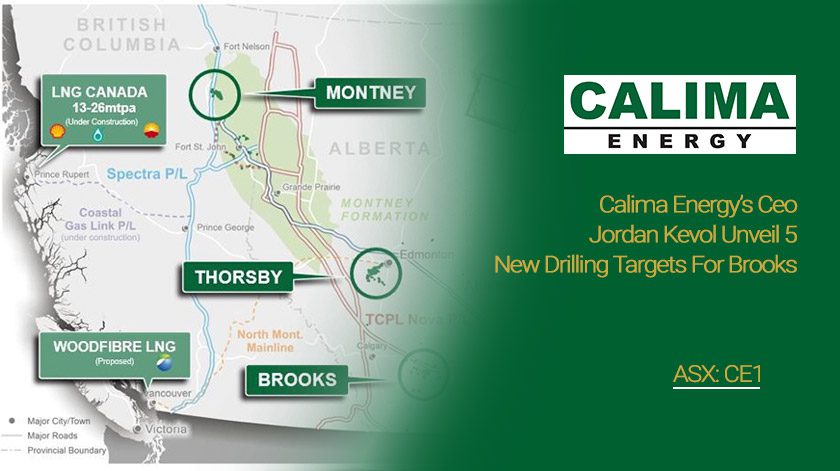

Calima Energy Limited (ASX: CE1) is an Australian oil and gas producer and explorer with high-quality assets, positive cash flow, and a strong focus on Environmental, Social, and Government Concerns (ESG). Headquartered in Perth, Australia, Calima has top-tier assets at Brooks and Thorsby in southern and central Alberta and a unique under-explored Montney in NE British Columbia, Canada. Calima Energy is compliant with international standards of Health, Safety, and Environment along with strong adherence to ESG norms across operations.Calima Energy’s (ASX: CE1) assets in the Brooks and Thorsby regions of the Alberta province are categorized as de-risked asset bases with existing wells and booked reserves. Additionally, these are low-cost, cash-flowing assets with huge potential for upside revenue in the future. The company is on an expansion path and focuses on development drilling to maximize the production to 5,500 boe/d by the end of 2022 through strategic acquisitions of adjoining tenements. The Calima Energy share price (latest) is AUD 0.135.Read More: Calima Energy Releases Inaugural ESG Report and Gemini Wells Update

Calima Energy Limited (ASX: CE1) is an Australian oil and gas producer and explorer with high-quality assets, positive cash flow, and a strong focus on Environmental, Social, and Government Concerns (ESG). Headquartered in Perth, Australia, Calima has top-tier assets at Brooks and Thorsby in southern and central Alberta and a unique under-explored Montney in NE British Columbia, Canada. Calima Energy is compliant with international standards of Health, Safety, and Environment along with strong adherence to ESG norms across operations.Calima Energy’s (ASX: CE1) assets in the Brooks and Thorsby regions of the Alberta province are categorized as de-risked asset bases with existing wells and booked reserves. Additionally, these are low-cost, cash-flowing assets with huge potential for upside revenue in the future. The company is on an expansion path and focuses on development drilling to maximize the production to 5,500 boe/d by the end of 2022 through strategic acquisitions of adjoining tenements. The Calima Energy share price (latest) is AUD 0.135.Read More: Calima Energy Releases Inaugural ESG Report and Gemini Wells UpdateRecent Updates on Calima Energy Projects

Calima Energy has recently announced the commencement of five Well Drilling Programs at Brooks, as below –

Calima Energy has recently announced the commencement of five Well Drilling Programs at Brooks, as below –Gemini Sunburst Program: a 3-Well Program

Gemini #10 (50% WI)

On 5 October 2022, Gemini #10 (50% WI) has been completely drilled and is expected to commence production in November. The well was drilled from the same pad as Gemini #3 and #9 and will link to the Calima’s 50% owned 15-23 Oil battery at South Brooks Field. One of the crucial factors to note is that the well is designed to boost hydrocarbon recovery in a known Sunburst Formation pool developed by vertical wells.Gemini #11 and Gemini #12

Gemini #11 and #12 (100% WI) will consecutively occur following the highly successful vertical well (Gemini #5), which was drilled in the first quarter of 2022 and evaluated the feasibility of the Sunburst Formation. These wells will significantly reduce costs as they will be on‐lease tie‐ins. The wells are to be drilled from the exact drilling pad as Gemini #5 and #8. Furthermore, these wells will leverage the recently developed pipeline installed in Q1, with the fluids flowing directly to our 2‐29 oil battery. These wells are created to grasp the unexploited reserves discovered from 3D seismic, apart from the geological data garnered from the drilling of Gemini #5 and #8.Sunburst Wells

Sunburst wells are conventional wells operating without fracture simulations. However, depending upon the type‐curve results at current commodity prices, these wells are expected to pay out within 12 months.2 Well Pisces Program

Pisces #6 & #7 (100% WI) are horizontal wells, they are a follow‐up to the existing Glauconitic Formation horizontal well (Pisces #4) – drilled at the start of 2022. The wells will be completed as horizontal multiphase fracture stimulated wells and tied into the 2‐29 oil battery during Q4 2022 through an on‐lease tie‐in, with a rated production output expected in Q1 2023.Waterflood Expansion J2J Pool

There is a great spur in production owing to water injection into the field. The action was considered a strategy for secondary Enhanced Oil Recovery (EOR). The second quarter witnessed the transformation of standing well into a water injector. Moreover, field pressures and cumulative voidage replacement continue to rise, enabling the energy Company to achieve a quick voidage replacement ratio greater than 1. Calima Energy also oversees the performance with planned capital, comprising additional water sources, injectors, and new producers.Montney Assets

Calima Energy is strengthening its efforts to derive maximum value from its Montney assets amid geopolitical developments such as the continuing surge in commodity prices, increasing demand for LNG exports from N.America and partial completion of the LNG Canada facility.Additionally, the company is strategising to have a mild winter program for 2022-2023 to facilitate the de-risk development on the site for potential growth in the following seasons through a joint venture. With a target of Q1 2025 the company has been in discussion with multiple potential partners, however, the deal is yet to be closed.The CEO And President Jordan Kevol

Calima Energy Senior Management is a very highly experienced and knowledgeable team of professionals known to generate returns for shareholder value. The CEO, Jordan Kevol, was a founder of Blackspur production or the Blackspur Oil Corp., a privately-held exploration and production company based in Calgary, AB, targeting the development of crude oil and natural gas in Alberta.He laid out the importance and strategic agenda for development drilling at Brooks:“Drilling at Brooks for our Q4 program has begun. We are pleased to follow up on our Gemini #5 discovery earlier this year with two more Sunburst horizontal wells into the pool. The Glauconitic wells we are drilling follow the successful Pisces #4 well drilled this summer. This modest program will set us up for continued drilling, growth, and free cash flow throughout 2023, particularly if we continue to have strong commodity pricing for our oil and gas. Every well in this program is an on-lease tie-in, as we aim, wherever possible, to utilise our significant infrastructure footprint in the Brooks area. This also results in quick on-stream timelines for our wells and more expedient cash flow.”

Calima Energy Senior Management is a very highly experienced and knowledgeable team of professionals known to generate returns for shareholder value. The CEO, Jordan Kevol, was a founder of Blackspur production or the Blackspur Oil Corp., a privately-held exploration and production company based in Calgary, AB, targeting the development of crude oil and natural gas in Alberta.He laid out the importance and strategic agenda for development drilling at Brooks:“Drilling at Brooks for our Q4 program has begun. We are pleased to follow up on our Gemini #5 discovery earlier this year with two more Sunburst horizontal wells into the pool. The Glauconitic wells we are drilling follow the successful Pisces #4 well drilled this summer. This modest program will set us up for continued drilling, growth, and free cash flow throughout 2023, particularly if we continue to have strong commodity pricing for our oil and gas. Every well in this program is an on-lease tie-in, as we aim, wherever possible, to utilise our significant infrastructure footprint in the Brooks area. This also results in quick on-stream timelines for our wells and more expedient cash flow.”The Impeccable Growth Potential for Calima Energy Investors

Calima Energy Limited has exponentially widened its production base from 2,900 to over 4,000 boe/d, which is more than 40% in a relatively short span of the past 12 months. The company affirms that following Q3 production averaging above 4,162 boe/d, its action plan has yielded positive results. Calima forecasts that the drilling programs in the fourth quarter will further intensify the production base, with a peak production rate to be achieved in the first quarter of 2023. The Company exhibits a great potential to propel the production rates throughout 2023 with the competitive pricing of the commodity, production rates, low debt, and the subsequent cash flow.For more information, visit the official website of Calima Energy Ltd.

Calima forecasts that the drilling programs in the fourth quarter will further intensify the production base, with a peak production rate to be achieved in the first quarter of 2023. The Company exhibits a great potential to propel the production rates throughout 2023 with the competitive pricing of the commodity, production rates, low debt, and the subsequent cash flow.For more information, visit the official website of Calima Energy Ltd.Disclaimer

The Content, including but not limited to any articles, news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video (Content), is a service of COLITCO LLP and is available for personal and non-commercial use only. The principal purpose of the Content is to educate and inform. The Content does not contain or imply any recommendation or opinion intended to influence your financial decisions and must not be relied upon by you as such. Some of the Content on this website may be sponsored/non-sponsored, as applicable, but is NOT a solicitation or recommendation to buy, sell or hold the stocks of the company(s) or engage in any investment activity under discussion. Colitco LLP is neither licensed nor qualified to provide investment advice through this platform. Users should make their own inquiries about any investments, and Colitco LLP strongly suggests the users seek advice from a financial adviser, stockbroker, or other professional (including taxation and legal advice), as necessary. Colitco hereby disclaims any and all the liabilities to any user for any direct, indirect, implied, punitive, special, incidental, or other consequential damages arising from any use of the Content on this website, which is provided without warranties. The views expressed in the Content by the guests, if any, are their own and do not necessarily represent the views or opinions of Colitco LLP. Some of the images/music that may be used on this website are copyrighted to their respective owner(s). Colitco LLP does not claim ownership of any of the pictures displayed/music used on this website unless stated otherwise. The images/music that may be used on this website are taken from various sources on the internet, including paid subscriptions, or are believed to be in the public domain. We have used reasonable efforts to accredit the source wherever it was indicated or found necessary.Visited 15 times, 1 visit(s) today