Much of the world’s attention is streamlined towards Western Canada’s unique geographical advantage for oil and natural gas production. The recent years have seen a substantial increase in production, which could be attributed to the prolific formation of Montney. This unconventional resource abundant across the borders of Alberta and British Columbia, has been a source of keen interest for major market players for decades. But only one managed to tap into the region’s full potential, allowing Canadian gas prices to reach an all-time high – Calima Energy.

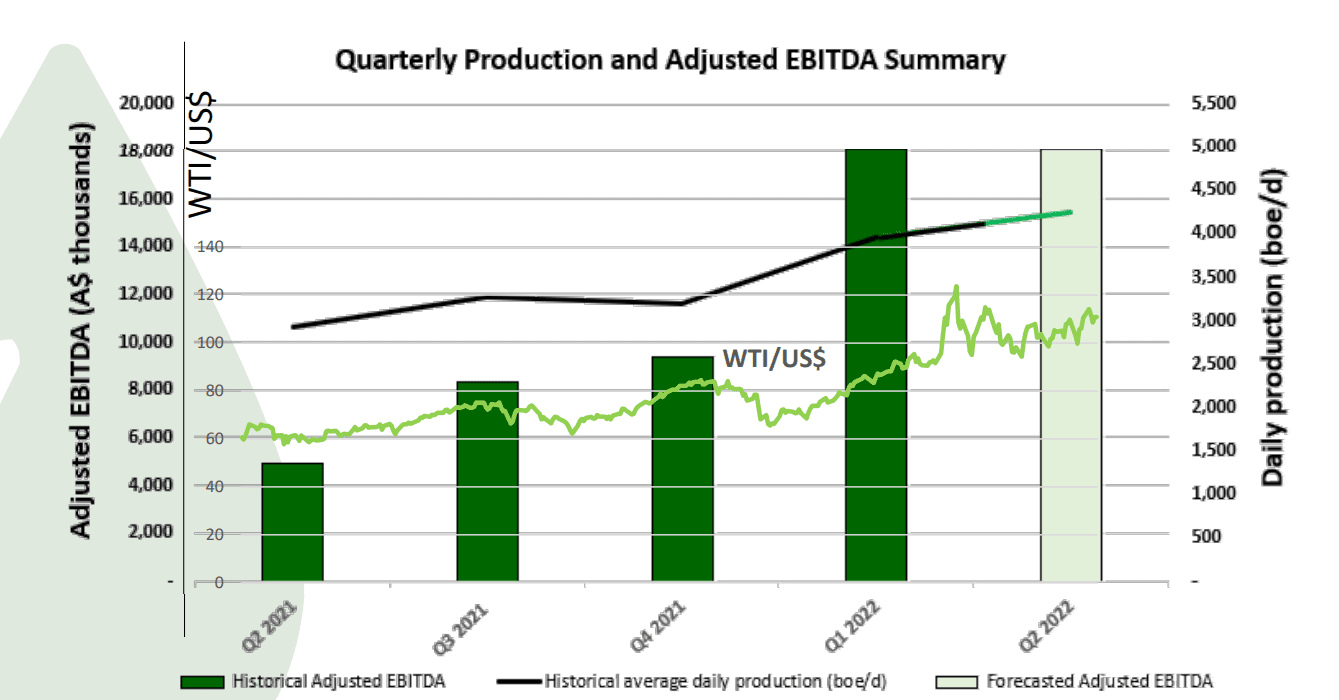

Following its strong production performance assets, Calima Energy and Chairman Glenn Whiddon are welcoming a half-year dividend program to reflect the underlying value of their assets more accurately.

How are they doing that? Let’s find out!

Calima Energy Oil Prices Peak at All Time High

What You Need to Know About Calima Energy in 2022

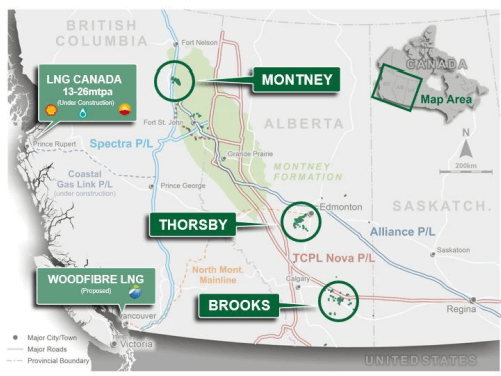

Calima Energy Limited (CE1 ASX), founded in 2005, is a globally renowned Canadian oil and gas company. It is primarily focused on exploring and developing new projects, which span its 60,000 acres of drilling rights. Some of its projects include Montney, Thorsby, and Brooks. Calima Energy’s strategic location allows it to tap into the region’s abundant hydrocarbon reserves for LNG export across domestic and international markets.

According to a recent company announcement, come the second half of 2022, Calima Energy, under the visionary leadership of Chairman Glenn Whiddon and other senior board members, will target a dividend payout of AUD 2.5 million. This will reflect a half-yearly yield of 2.5% at the current share price.

The company hopes that subsequent dividend distribution will be shaped by energy prices, capital expenditures, maturity, and performance of the current hedge books, which are expected to commence from the end of this year.

Under the Corporations Act 2001, Calima Energy also intends to undertake an on-market buy-back of shares up to 10%. The buy-back will last for a 12-month period. This buy-back does not require the approval of shareholders. Moreover, it is expected to benefit shareholders by improving cash flow per share and return on equity.

However, the actual number of shares to be purchased will be subject to the market conditions, the company’s share prices, and future capital requirements. In response to this announcement, Calima Energy CEO Jordan Kevol said, “Calima’s strong operating performance in the last quarter has contributed to a strong capital position for the company. I look forward to meeting with shareholders during my trip to Australia.”

This Australian roadshow will cover key venues in Sydney, Brisbane, Perth, and Melbourne. Interested shareholders and brokers could register for these investor briefings with the management here.

Calima Energy Financial Highlights

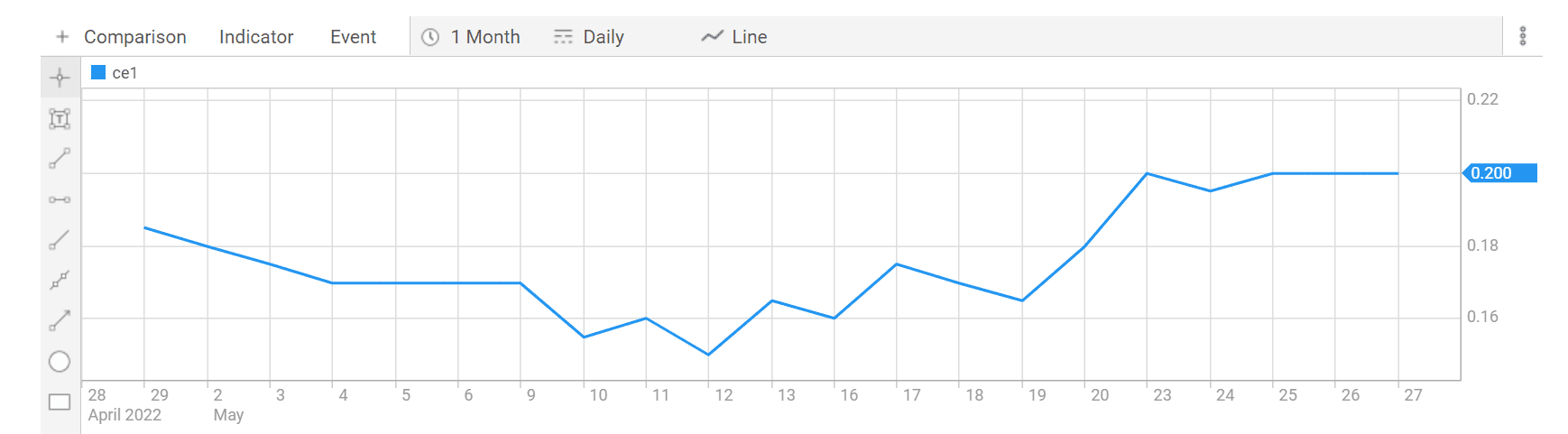

As preparations for new changes continue in full force, funding from original operations remains consistent. As listed on the Australian Stock Exchange, currently, Calima Energy’s share price stands at AUD 0.200, with a market capitalization of AUD 123.01M. The bidding range for share prices lies between AUD 0.195 and AUD 0.200. Since being listed in July 2006, the company has issued 615,084,228 shares, with an average share volume of 2,670,553.

The Major Operations of Calima Energy

Following its merger and binding agreement with Blackspur Oil Corp in 2021, Calima Energy has expanded the scope of its ambitious projects across Montney and Alberta. With the intention of creating a self-funding energy company, the board members are now targeting the rising energy markets in North America and focusing on high-quality production assets.

The key operations of Calima Energy are: Brooks, Thorsby, and Montney.

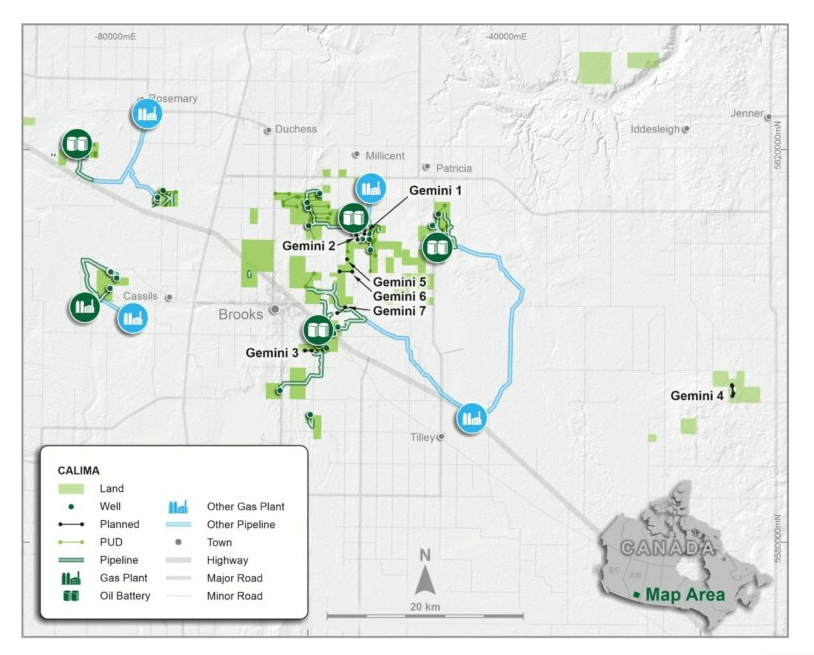

Brooks – Targeting Sunburst Wells

As of April 2022, Brooks production was at 2,700 boe/d, with 65 wells drilled to date. The operation has identified 130 net locations, out of which 31.75 have been booked so far. It covers an area of 40,600 net acres in total, with complete year-round access. The total costs of the drilling operation averaged at C$1.2 million per horizontal well, which was inclusive of the process of drilling, completing, equipping, and tie-in. The Brooks Sunburst J2J Pool Waterflood project initiated in 2020 is expected to continue expansion through 2022 year-end and show results in the near term. The production in Brooks comes from Sunburst and Glauconitic formations.

The Sunburst wells do not require hydraulic fracturing stimulation since they are open hole horizontal wells. A combination of lack of need for stimulation, shallow target depth (~1000m TVD and 77m lateral length), and short tie-in, suggests that the estimated all-in cost for each well would be C$1 million.

As the project advances and implements advanced oil recovery projects, Brooks is expected to realize additional reserves.

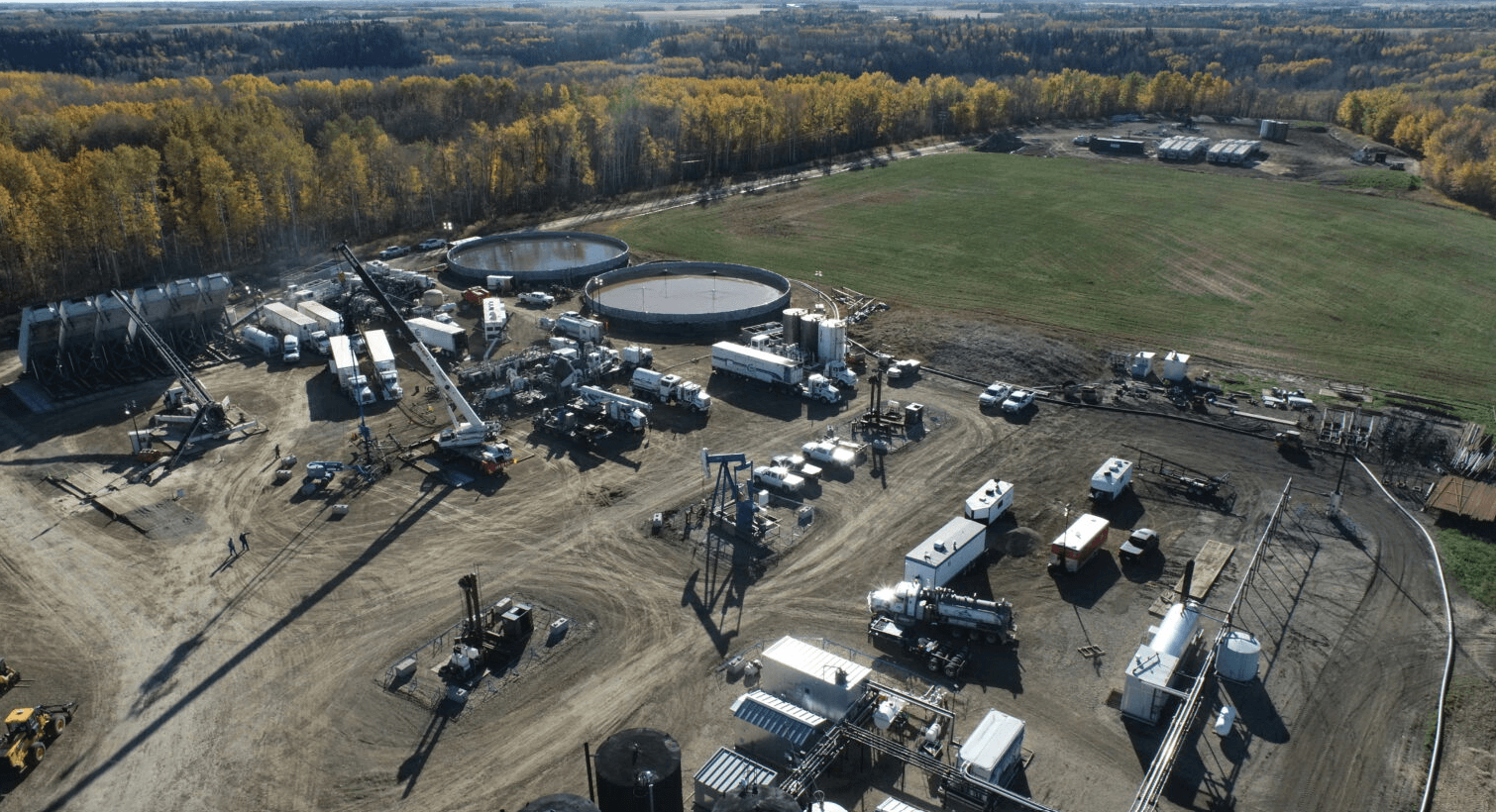

Thorsby – An Abundance of Sparky Formation Wells

As of April 2022, the current daily production of the Thorsby operations lies at 1,700 boe/d. 15 wells have been drilled under this operation so far since 2014 in the Sparky Formation. It provides a land base of approximately 98 net sections with a network of multi-well pads. The Thorsby area has an oil processing capacity of 3,000 bbl/d and Blackspur has invested over C$5 million in building infrastructure here. It has a rich inventory of wells, with 12 Nisku Formation wells, 89 Sparky Formation Wells, and 24 Sparky PUD locations.

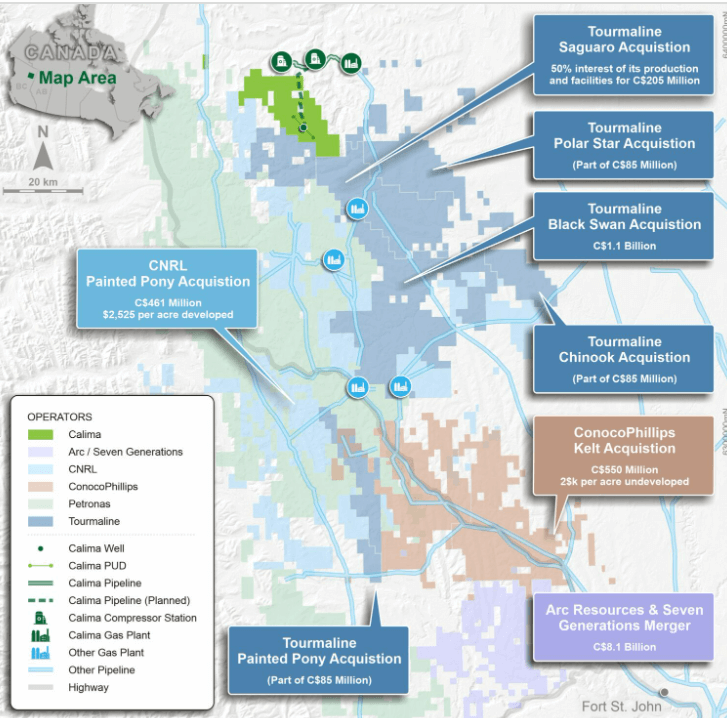

Montney – Discovering Unconventional Petroleum

Montney is a strategic oil and gas source for Eastern Canada and the US. The Lower Triassic age formations have generated interest in oil and gas exploration since the 1950s. It is dominated by siltstones and dolomitization. However, it is only recently, with advancements in horizontal drilling, completion design, and multi-stage hydraulic fracturing that development of siltstones has become possible. Calima Energy acquired the Tommy Lakes infrastructure in April 2020, and the facilities have a replacement value of C$85 million. Between 2021 and 2022, close to C$9 billion Montney M&A transactions were completed.

Calima uses proprietary geological workflow to identify areas with significant quantities of natural gas liquids and oil and capture them within British Columbia, where it holds Montney rights in the “liquids rich” fairway.

Calima Energy’s Pillar of Strength: Chairman Glenn Whiddon

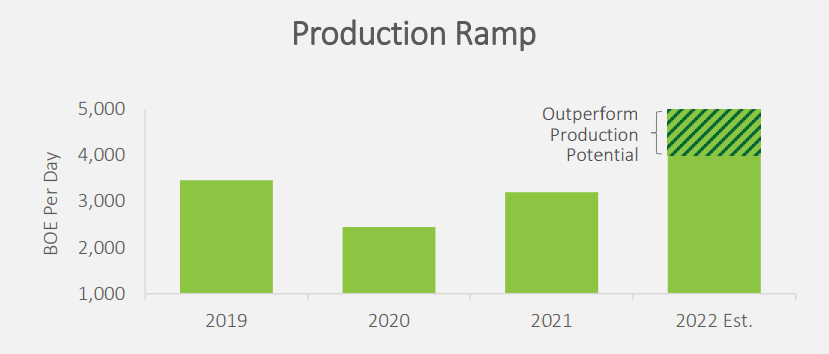

Glenn Whiddon is a successful Australian businessperson, who has driven the recent positive transformations in the operations of Calima Energy as its Chairman through his skillful grasp of equity capital markets, corporate advisory, and the production of natural resources. Talking about the company’s growth, he stated, “We’re continuing to grow our production from our existing operations of about 4200 boe/d. To do that we decided it was best practice to build a pipeline, which will allow the product to go through, for our production base to grow, lower our operation costs, and increase efficiency.”

Besides playing a crucial role at Calima Energy, Mr. Whiddon is currently the Director of 12 different international public listed companies, along with being a board member for 8 others. Formerly, he was the Chief Executive Officer, Executive Chairman, and President of the European and Mediterranean Oil and Gas Company, Grove Energy Limited. He has been involved in operations across Italy, Slovenia, the UK, Dutch North Seas, Romania, and Tunisia.

Additionally, he has held important offices in various capacities at Statesman Resources, North River Resources, Arizona Lithium Ltd., Arrow Minerals Ltd., Europa Metals Ltd., Washington Resources Ltd., Lagral Capital SCP, and Auroch Minerals Ltd.

In a Nutshell: Calima Energy Insights for Investors

To summarize, there’s a lot to look forward to in terms of the company’s growth potential and innovations. Here a just a few key insights:

- Calima Energy focuses on the responsible development of top-tier assets in Western Canada.

- Its low-decline and stable base production in Brooks and Thorsby offer considerable growth opportunities with 82 wells on production.

- The Montney liquids-rich gas development project at Tommy Lakes has a capacity of more than 10,000 barrels of oil equivalent per day.

- It is well-equipped to handle macro-level pressures through strategic market exposure and combatting inflationary costs with secure margins.

As the world scrambles for oil, Canada triumphs with its third-largest oil reserves in the world. Amidst significant competition in this niche segment, Calima Energy emerges as an expert in balancing resource production with environmentally responsible practices. For more information about the company, please visit their website or LinkedIn.

Western Canada’s Rich Oil and Natural Gas Reserves

Disclaimer

The Content, including but not limited to any articles, news, quotes, information, data, text, reports, ratings, opinions, images, photos, graphics, graphs, charts, animations, and video (Content), is a service of COLITCO LLP and is available for personal and non-commercial use only. The principal purpose of the Content is to educate and inform. The Content does not contain or imply any recommendation or opinion intended to influence your financial decisions and must not be relied upon by you as such. Some of the Content on this website may be sponsored/non-sponsored, as applicable, but is NOT a solicitation or recommendation to buy, sell or hold the stocks of the company(s) or engage in any investment activity under discussion. Colitco LLP is neither licensed nor qualified to provide investment advice through this platform. Users should make their own inquiries about any investments, and Colitco LLP strongly suggests the users seek advice from a financial adviser, stockbroker, or other professional (including taxation and legal advice), as necessary. Colitco hereby disclaims any and all the liabilities to any user for any direct, indirect, implied, punitive, special, incidental, or other consequential damages arising from any use of the Content on this website, which is provided without warranties. The views expressed in the Content by the guests, if any, are their own and do not necessarily represent the views or opinions of Colitco LLP. Some of the images/music that may be used on this website are copyrighted to their respective owner(s). Colitco LLP does not claim ownership of any of the pictures displayed/music used on this website unless stated otherwise. The images/music that may be used on this website are taken from various sources on the internet, including paid subscriptions, or are believed to be in the public domain. We have used reasonable efforts to accredit the source wherever it was indicated as or found to be necessary.