Iluka Resources Limited (ASX:ILU) has recently come under the spotlight as shareholders grapple with a 6.7% return over the past three years, including dividends. The company has recently witnessed a 13% rise in share prices. Stock watchers have rated this performance as outpacing the market’s meagre 2.8% growth earlier.

Iluka Resources Share Price ASX Amid Market Resilience

Individual stocks can still capture investors’ attention in a market where index funds often provide stable returns. Iluka Resources Limited has witnessed a share price surge that has not gone unnoticed. Yet, the recent returns hint at a cautious market sentiment. The company’s compound earnings per share (EPS) growth of 16% per year over the past three years is an achievement. However, investors are approaching Iluka Resources Limited (ASX: ILU) with prudence. This is reflected in the relatively low price-to-earnings (P/E) ratio of 9.04. Meanwhile, insiders within Iluka Resources Limited have shown confidence by making significant purchases in the last year.

Total Shareholder Return with Iluka Resources Share Price ASX

The total shareholder return (TSR) becomes a critical metric beyond share price movements. Iluka Resources Limited has demonstrated a TSR of 148% over the last three years. It means this has surpassed the more modest share price return. The boost comes from the company’s commitment to dividends. It also underlines the impact of such payouts on the entire investor experience.

Short-Term Hurdles for Long-Term Gains?

Iluka Resources Limited’s recent one-year TSR of 6.7%, including dividends, suggests a moderation period. However, a broader view over five years paints a more impressive picture with a TSR of 20% per annum. Investors cannot interpret whether this slowdown indicates a peaked stock or a necessary stabilisation period. Either way, the company is all set to refine its operations.

Caution Amidst Low P/E Ratio

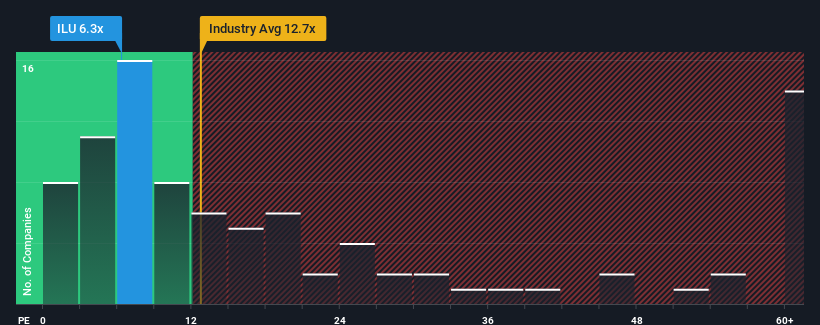

Digging deeper into Iluka Resources Limited and its valuation, the current P/E ratio of 6.3x might appear enticing compared to the broader Australian market. However, this low ratio raises questions about the company’s earnings performance. The Iluka share price ASX has faced recent challenges as its earnings declined faster than industry peers, contributing to the subdued P/E ratio.

Investors are urged to exercise caution, considering the potential for earnings recovery against the risk of continued decline. The future trajectory of Iluka Resources Limited’s share price hinges on the company’s ability to explore these challenges and restore investor confidence.

Notably, the shares of Iluka Resources Limited are witnessing a story of growth, although investors need to be cautious in making an investment decision. Amidst shareholders’ increasing reactions and scrutiny of the company’s response to temporary obstacles, the volatile equity market offers hope and care. Investors need to go through a detailed test, exemplifying Iluka Resources’ potential to face uncertainties and lead the warning signals to make a calm decision in today’s setting.

About Iluka Resources Limited (ASX: ILU)

Iluka Resources Limited is a multinational critical minerals company located in Australia. The firm has around 70 years of industry know-how and operation in prospecting, mining, processing, marketing, and site activities. Its fundamental principle is that all of its actions and decisions should generate an environmentally and economically sustainable value. Iluka deals with high-purity grade Titanium dioxide feedstocks, rare earth minerals, and quality zircon products to its customers in several countries around the globe. Capel is the company’s significant base, a town in southwest Australia.